The Internal Revenue Service has approved a $2,000 direct deposit payment for eligible U.S. citizens in February 2026, offering financial relief to households that meet specific requirements. This federal payment is designed to support taxpayers during a time when many families continue to manage rising living costs. Understanding how the payment works, who qualifies, and when the money may arrive can help recipients avoid confusion and delays.

What the $2,000 Direct Deposit Is About

The $2,000 payment is being issued by the Internal Revenue Service as a direct deposit to eligible individuals and families. The goal of this payment is to provide timely assistance through an automated system based on existing tax records. The IRS has confirmed that this payment does not require a separate application for most people, as eligibility is determined using previously filed tax information.

Who Is Eligible for the February 2026 Payment

Eligibility for the $2,000 direct deposit depends mainly on income limits, tax filing status, and participation in certain federal assistance programs. Taxpayers who have filed valid and up-to-date tax returns and fall within the approved income thresholds are given priority. Individuals with verified records in IRS systems are expected to receive payments automatically, provided all information is accurate.

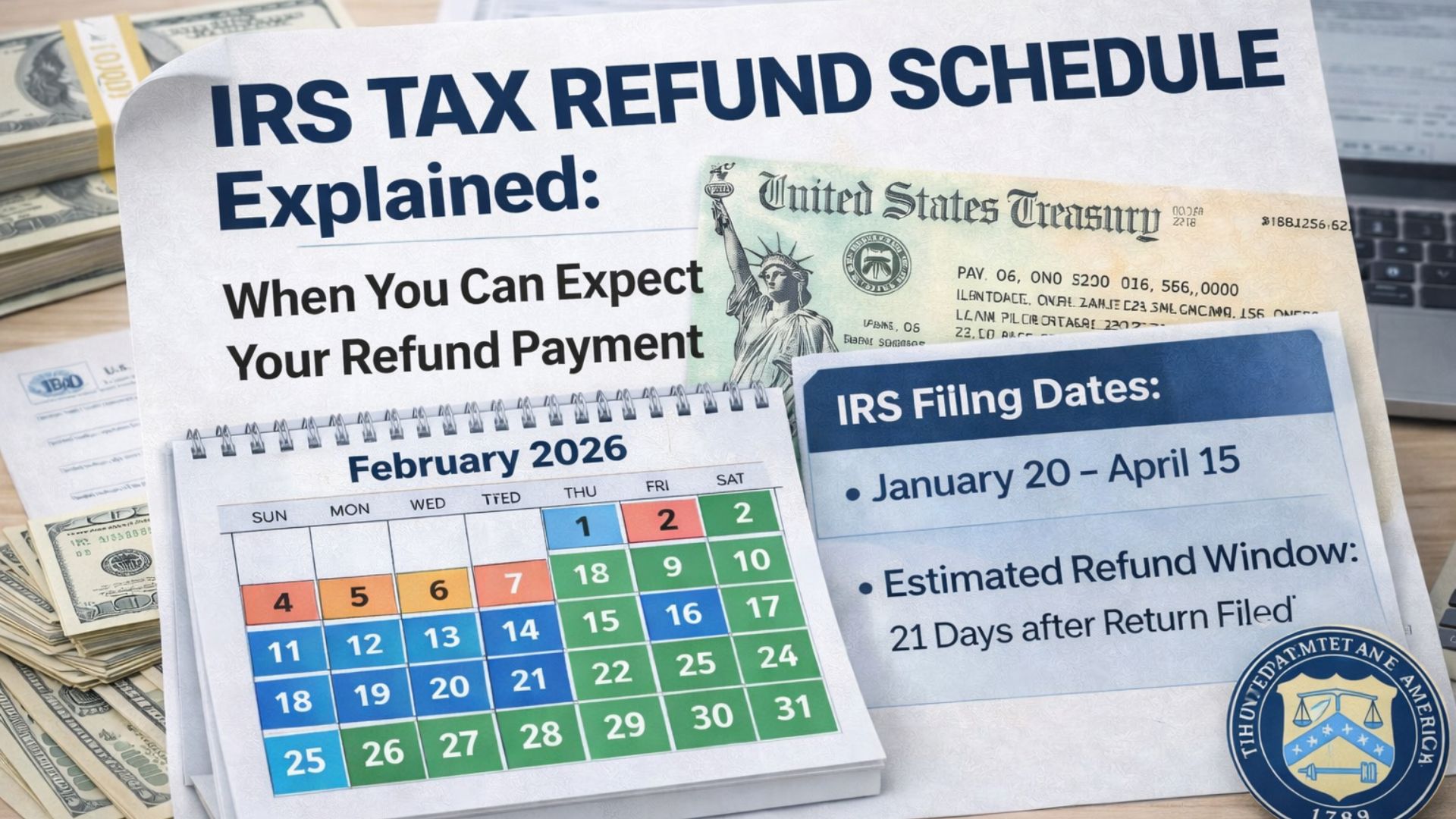

When Payments Are Expected to Arrive

Payments are scheduled to begin in mid-February 2026 for taxpayers who have confirmed bank account details on file with the IRS. Those who filed electronically and selected direct deposit are likely to receive their funds first. Taxpayers who filed paper returns or whose information requires verification may experience delays. In such cases, payments may arrive later than expected, depending on processing times.

How to Track and Manage Your Payment

The IRS provides official online tools that allow taxpayers to track payment status and confirm deposit details. These tools help recipients see whether a payment has been issued, approved, or is still being processed. If bank account information needs to be updated, taxpayers should only use official IRS portals. It is strongly advised to avoid third-party websites or services claiming to speed up payments, as these claims are not authorized.

Steps to Avoid Delays

To ensure timely payment, taxpayers should double-check that their tax filings are complete and accurate. Bank account numbers and personal information must match IRS records exactly. Any mismatch or missing detail can cause delays or require reprocessing. Staying informed through official IRS announcements is the safest way to remain updated.

Final Thoughts on the February 2026 Deposit

The approved $2,000 direct deposit for February 2026 offers meaningful financial support to eligible Americans. By meeting eligibility rules, keeping tax information current, and using official tracking tools, recipients can expect a smooth and secure payment process. Awareness and accuracy remain the key factors in receiving funds without complications.

Disclaimer: This article is for informational purposes only and does not constitute financial or legal advice. Payment amounts, eligibility rules, and schedules may change based on official IRS or U.S. Treasury updates. Always refer to official government sources or consult a qualified professional for personalized guidance.