As 2026 begins, many households across the United States are feeling financial pressure from rising rent, food prices, heating costs, and unpaid bills carried over from the holidays. During this stressful period, claims about a new $2,000 IRS direct deposit for everyone have spread quickly online. For people hoping for relief, these reports sound reassuring, but it is important to separate confirmed facts from online speculation.

Where the $2,000 Payment Claims Are Coming From

The recent claims about a universal $2,000 direct deposit appear to be based on confusion rather than an official announcement. In past years, emergency stimulus payments were approved during national crises, and those memories still influence expectations today. Some online posts mix past relief programs, estimated tax refunds, and informal policy discussions, presenting them as if they are active and confirmed.

What the IRS Has Actually Confirmed

As of now, there is no verified IRS announcement approving a nationwide $2,000 direct deposit for all taxpayers in February 2026. No new stimulus law has been passed by Congress, and the IRS has not issued any official guidance describing such a payment. The IRS cannot send large-scale payments unless Congress authorizes funding through legislation.

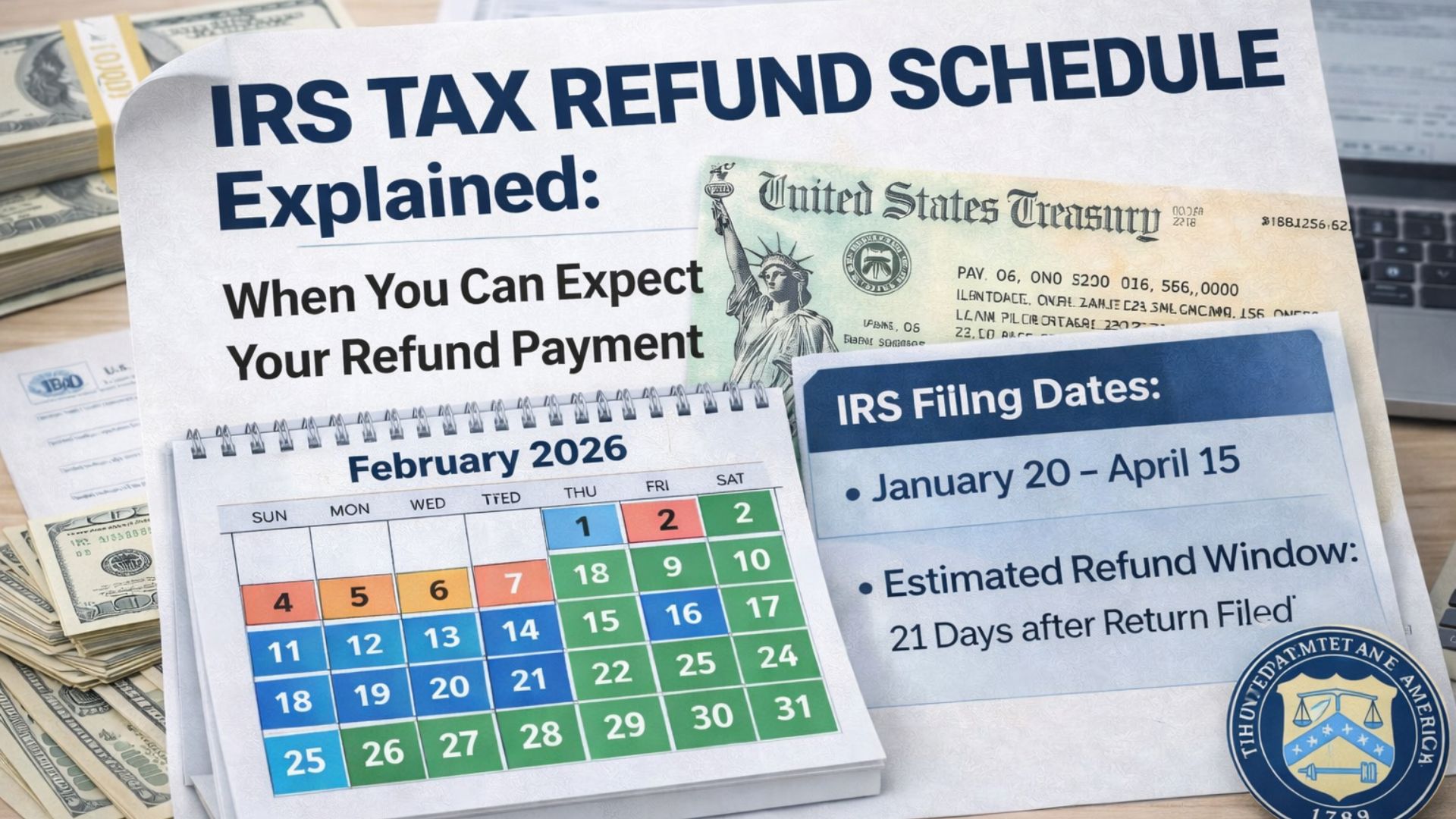

Why Some People May Still Receive Around $2,000

Even without a new relief program, some taxpayers may still see deposits close to $2,000 early in the year. These payments are usually standard tax refunds. When taxpayers overpay during the year or qualify for refundable tax credits, the IRS returns that money through refunds. Because the amounts can be similar to past stimulus checks, they are often mistaken for new government payments.

Understanding Tax Refunds and Credits

Refundable credits such as the Earned Income Tax Credit and Child Tax Credit can significantly increase refund totals. When refunds arrive as direct deposits, especially during February, they may look like special assistance. In reality, they are simply the return of money already paid or credits earned under existing tax laws.

Why Automatic Deposits Cause Confusion

Many posts claim that the payment will be sent automatically using recent tax records. While this sounds official, it closely matches how tax refunds already work. Automatic processing does not mean a new relief program exists. It only reflects the IRS’s standard refund system.

How to Protect Yourself From False Claims

Instead of relying on unconfirmed payment rumors, taxpayers should focus on what they can control. Filing accurate tax returns early and keeping bank details updated helps avoid delays. Checking only official IRS communications is the safest way to stay informed.

There is no confirmed IRS plan for a universal $2,000 direct deposit in February 2026. Any payments received near that amount are tied to individual tax situations, not a new relief program.

Disclaimer: This article is for informational purposes only and does not provide financial, tax, or legal advice. IRS refund amounts, eligibility rules, and payment timelines depend on official legislation and individual circumstances. Readers should consult the official IRS website or a qualified professional for accurate and personalized information.