For many Americans, tax season is more than just paperwork. It is a waiting period filled with hope, stress, and careful planning. A tax refund can help cover overdue bills, rebuild savings, or simply provide breathing room in a tight budget. As the IRS refund schedule for 2026 takes shape, taxpayers want clear answers about how long refunds may take and what they can do to avoid delays.

What the IRS Refund Schedule Means for 2026

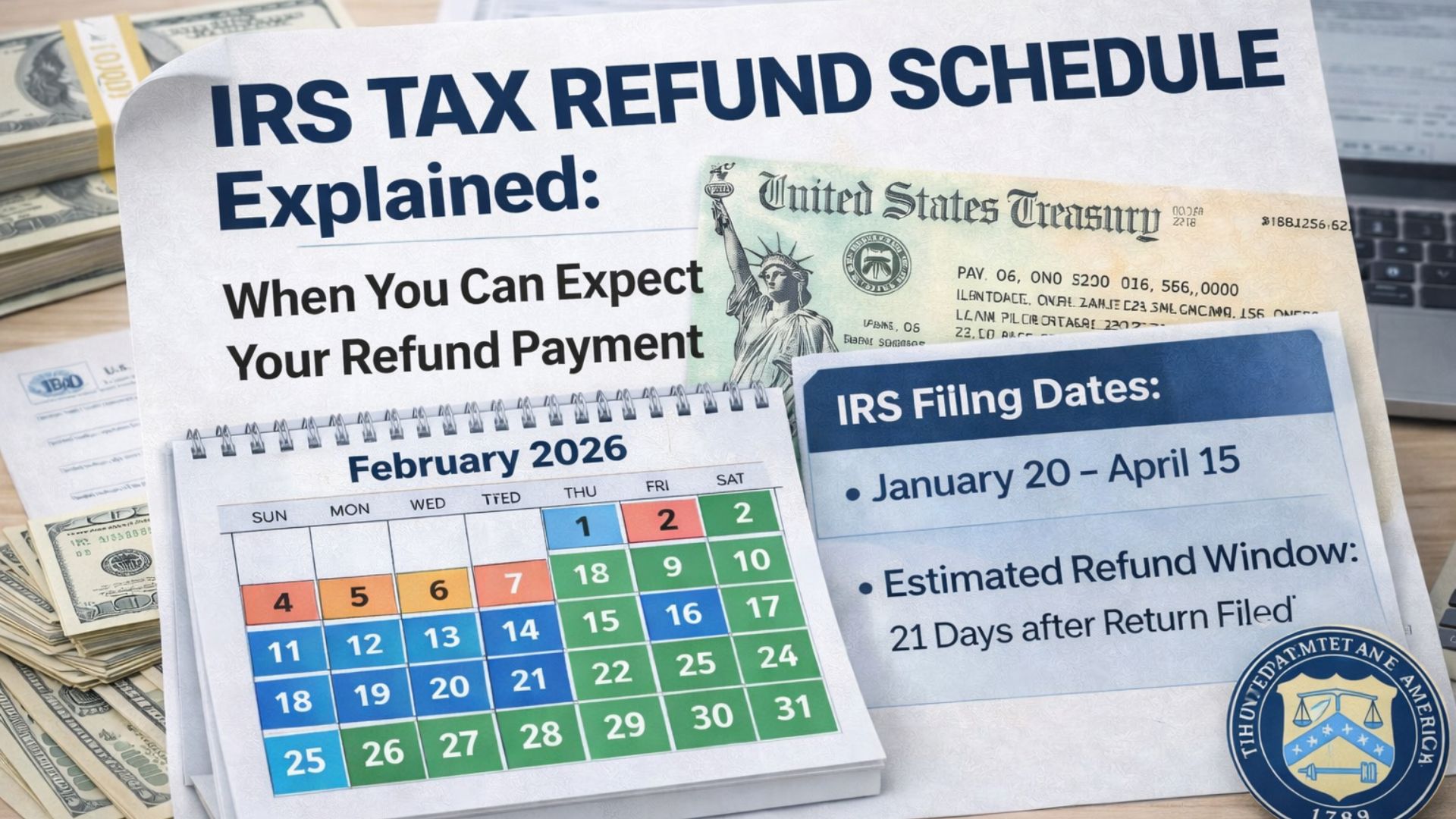

Every year, the IRS processes millions of tax returns using a structured system. In 2026, the agency continues to open the tax filing season in late January, allowing taxpayers to submit returns electronically or by mail. Once a return is accepted, most people can still expect their refund within about twenty-one days if there are no issues. This familiar timeline remains the standard for straightforward returns.

How Filing Method Affects Refund Speed

One of the biggest factors in refund timing is how you file and how you choose to receive your money. Electronic filing moves through IRS systems much faster than paper returns, which require manual handling. Direct deposit is also significantly quicker than receiving a paper check by mail. In 2026, the IRS is placing even more emphasis on electronic processing, meaning digital filers with direct deposit are likely to see the fastest results.

Refund Delays for Certain Tax Credits

Not all refunds follow the same schedule. Taxpayers who claim refundable credits such as the Earned Income Tax Credit or the Additional Child Tax Credit are subject to federal law that delays refunds until mid-February. Even if you file early, the IRS must hold these refunds for additional verification. This delay is not a penalty or a mistake, but a required safeguard against fraud.

Why Some Refunds Take Longer

Refunds can be delayed for several reasons. Simple errors like incorrect Social Security numbers, mismatched names, or wrong bank details can slow processing. Returns with complex income, amended filings, or extra deductions may also require manual review. In 2026, stronger identity verification checks may temporarily hold some returns while information is confirmed.

Tracking Your Refund Status

To reduce uncertainty, the IRS provides the “Where’s My Refund?” tool. This online tracker allows taxpayers to see whether their return has been received, approved, or sent. It is often the most reliable way to get updates specific to your own return rather than relying on general timelines.

Planning for a Smoother Tax Season

Accuracy matters as much as speed. Double-checking personal details and income information can prevent avoidable delays. Filing early, using electronic methods, and choosing direct deposit remain the best ways to receive refunds on time.

Disclaimer: This article is for informational purposes only and does not provide tax, financial, or legal advice. IRS refund timelines, eligibility rules, and processing times depend on individual circumstances and official regulations. Always refer to the official IRS website or a qualified tax professional for accurate and personalized guidance.