The idea of a $2,000 federal direct deposit arriving in February 2026 has drawn strong attention from taxpayers across the country. According to official guidance, the Internal Revenue Service has confirmed that eligible individuals and households may receive this payment as part of federal financial support efforts. The goal of this deposit is to provide timely relief to those who meet specific income and tax filing conditions. Understanding how eligibility works and how payments are processed can help taxpayers avoid confusion and delays.

What the $2,000 Federal Direct Deposit Means

The $2,000 payment is not a random or automatic benefit for everyone. It is tied closely to federal tax records and existing IRS data. This means the payment is designed to reach taxpayers who already fall within defined income limits and filing requirements. For many households, this deposit can help cover essential expenses such as housing costs, utilities, medical needs, or outstanding bills. The payment is meant to offer short-term financial stability rather than long-term assistance.

Who Is Likely to Be Eligible

Eligibility for the February 2026 deposit is mainly based on income level, tax filing status, and participation in certain federal programs in previous years. Individuals and families who have filed recent tax returns and stayed within income thresholds are the most likely to qualify. The IRS and the U.S. Treasury publish official rules that determine who qualifies, and these guidelines should always be treated as the final authority on eligibility.

How the Payment Will Be Sent

For most eligible taxpayers, no additional action is required. If bank account information is already linked to IRS records, the $2,000 amount will be sent automatically through direct deposit. This is the fastest and most secure method. Taxpayers who recently changed banks or updated personal details should confirm that their information is current to avoid delays or returned payments.

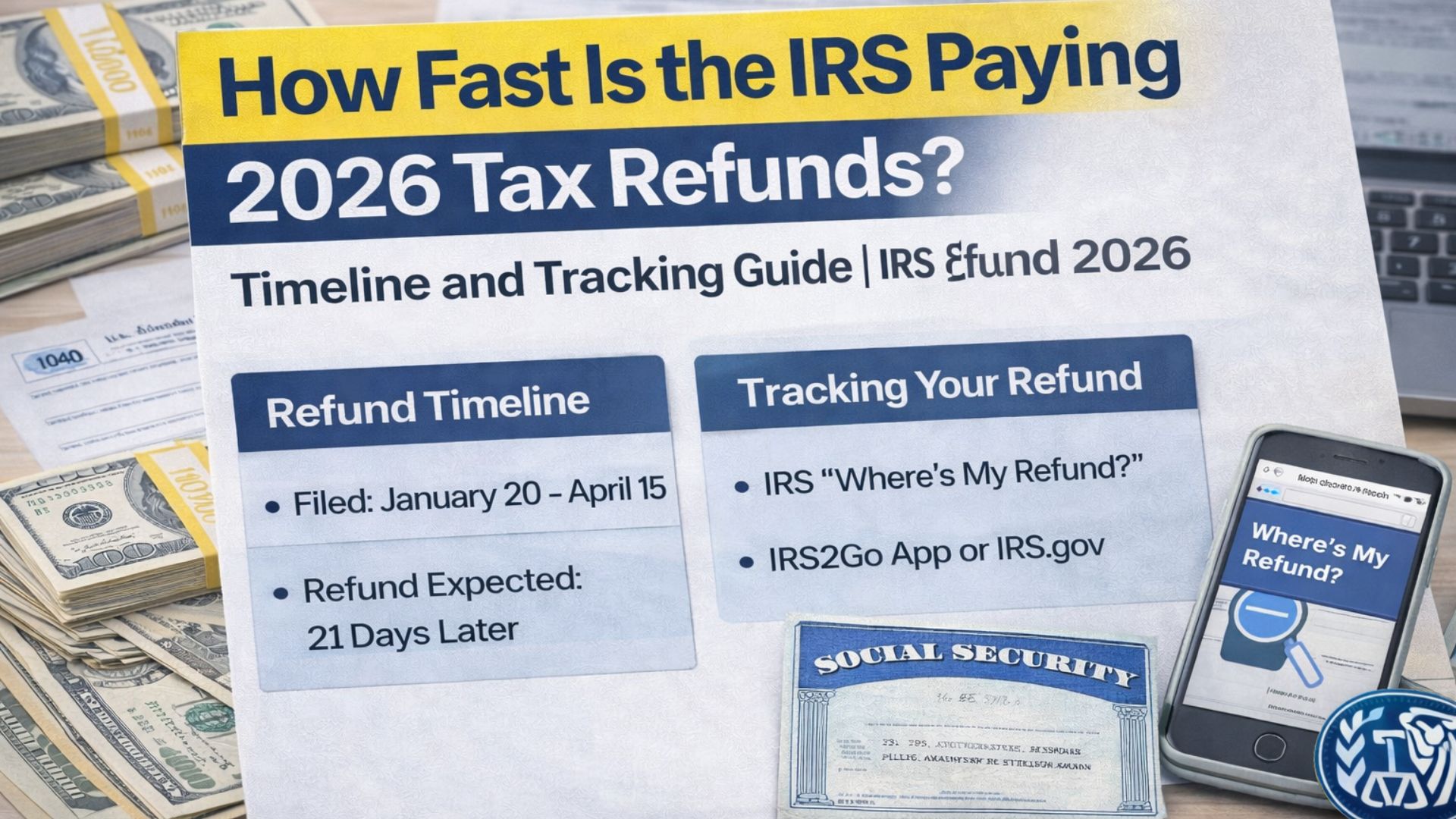

Expected Payment Timing in February 2026

The IRS has indicated that payments will be issued primarily during February 2026. While many recipients may see funds arrive quickly, some delays are possible. These delays often affect paper filers or accounts that require extra verification. Official IRS online tools allow taxpayers to track the status of their payment and check for any issues that may slow processing.

Why Staying Updated Matters

Keeping tax filings accurate and personal information updated is essential. Relying only on official IRS portals helps protect taxpayers from misinformation and scams. Staying informed ensures the payment is received securely and without unnecessary stress.

Disclaimer: This article is for informational purposes only. Payment amounts, eligibility requirements, and distribution timelines are subject to change based on official announcements from the IRS and the U.S. Treasury. Readers should refer to official government sources for the most accurate and up-to-date information.