As February 2026 begins, many households are paying close attention to updates about a one-time direct deposit payment being issued by the federal government. With winter utility bills, healthcare costs, and everyday living expenses staying high, this payment is viewed as short-term financial support for eligible individuals and families. Unlike regular tax refunds, which return excess taxes paid during the year, this deposit is designed as targeted relief for households within defined income limits.

Purpose of the 2026 IRS Direct Deposit Payment

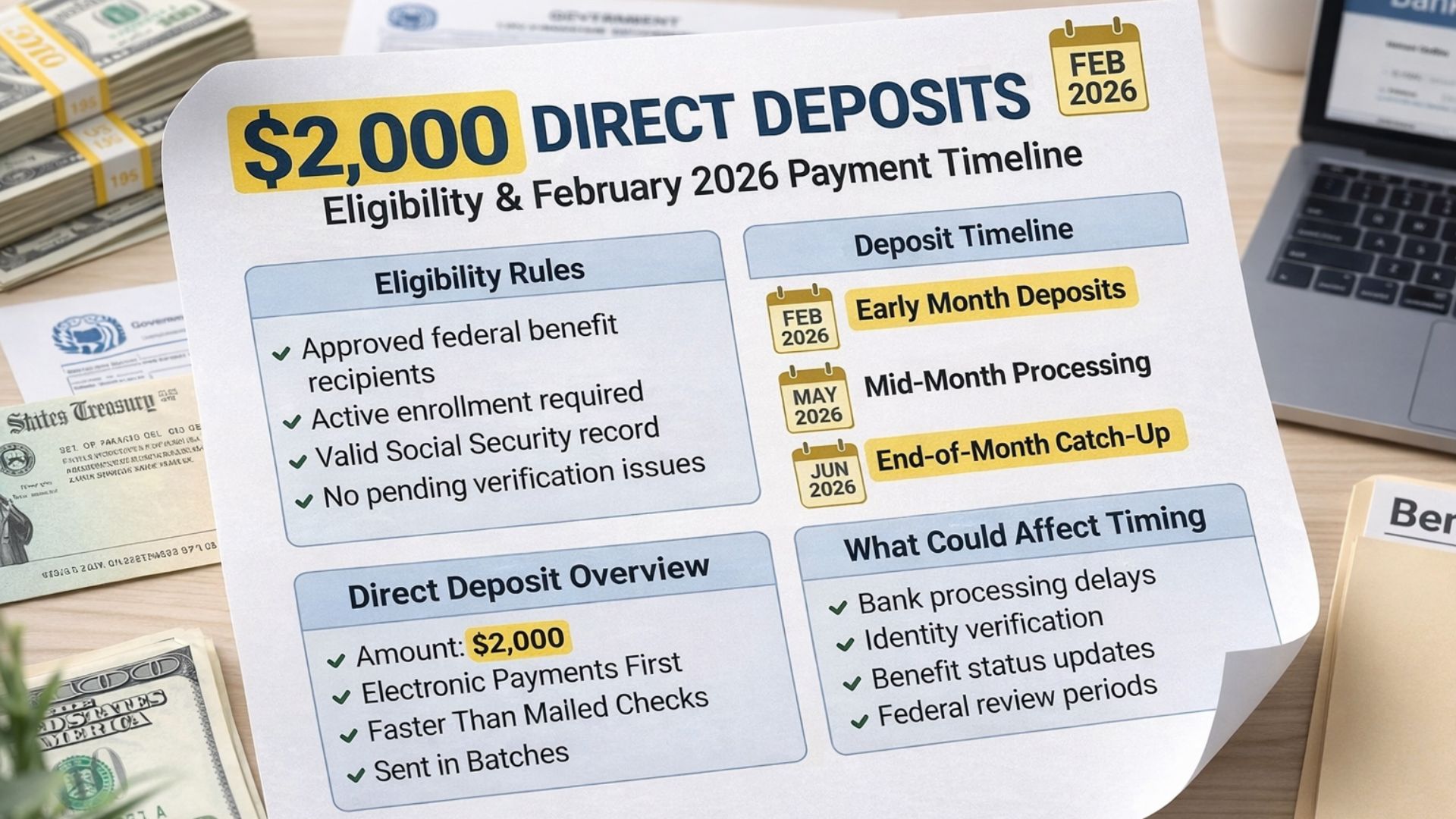

The main goal of the 2026 direct deposit payment is to provide immediate financial relief at a time when expenses are typically higher. Early in the year, households often face increased costs related to heating, insurance renewals, and medical care. By issuing a one-time payment of up to $2,000, federal authorities aim to reduce dependence on high-interest credit cards or short-term borrowing for essential needs.

This approach also supports the broader economy by injecting money directly into household spending. When families can cover basic expenses more easily, financial stress is reduced and stability improves during the first quarter of the year.

How the Program Is Designed to Work

The program is structured to be efficient and fast. By using existing systems at the Internal Revenue Service, the government avoids lengthy application processes that often delay assistance. Most recipients do not need to apply because eligibility is determined using information already available from recent tax filings. This allows payments to reach bank accounts more quickly when they are needed most.

Who Is Eligible for the Payment

Eligibility for the 2026 direct deposit payment is based mainly on income and residency information from the most recent tax return on file. The program is progressive, meaning households with low to moderate earnings receive the most benefit. Adjusted gross income and filing status are used to identify qualified recipients automatically.

Individuals who have not filed taxes for several years or whose personal details are outdated may experience delays. This payment is not a loan and does not need to be repaid in future tax years.

Using the Payment Wisely

Financial experts recommend using the payment for essential and non-discretionary expenses. Paying down high-interest credit card balances or covering overdue utility bills can save money over time by reducing interest and late fees. Households with stable finances may choose to place the funds in savings to strengthen their emergency reserves, turning short-term relief into longer-term security.

Payment Timeline and Delivery

The IRS is distributing payments in phases to manage processing volume. Those with direct deposit information already on file are expected to receive funds first. Individuals without bank details may receive paper checks or debit cards, which take longer due to mailing time. Most payments are expected to be completed within the first quarter of the year.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Payment amounts, eligibility requirements, and distribution timelines depend on official government rules and individual circumstances. Readers are advised to consult official IRS communications or a qualified professional for guidance specific to their situation.