As the 2026 tax filing season moves forward, millions of Americans are closely watching their IRS tax refund status. For many households, a tax refund is not just extra money but an important financial tool used to cover regular expenses, reduce debt, or build savings. Understanding how the IRS refund process works helps taxpayers avoid confusion, manage expectations, and reduce stress while waiting for their money.

How the IRS Refund Process Works in 2026

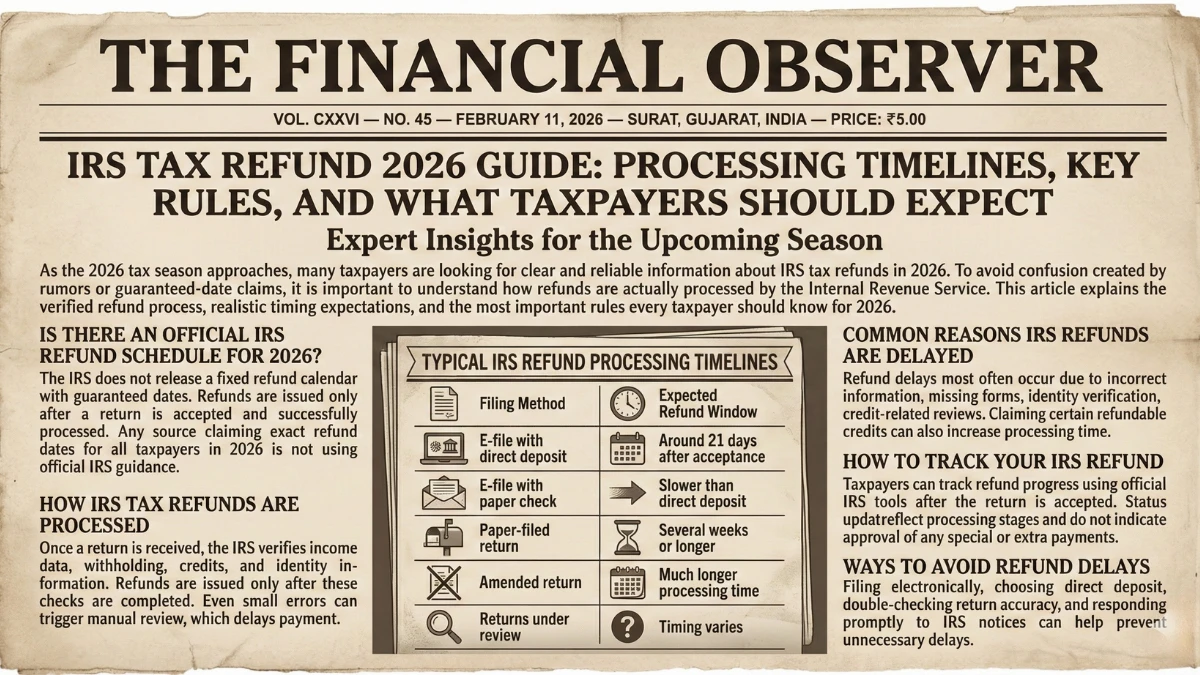

Once a tax return is submitted, it enters the IRS processing system. Electronic returns are usually acknowledged within 24 hours, confirming that the IRS has received the filing. After acceptance, the IRS reviews the return for accuracy by checking income details, withholding amounts, claimed credits, and identity information. Refunds are only issued after these checks are completed successfully.

Typical Refund Timeline for Most Taxpayers

For most taxpayers who file electronically and choose direct deposit, refunds are generally issued within about 21 days after the return is accepted. This timeline is an estimate, not a guarantee, and individual circumstances may affect it. Returns that are accurate and complete tend to move through the system faster than those requiring corrections or extra review.

Filing Method and Its Impact on Refund Speed

The method used to file a tax return plays a major role in refund timing. Electronic filing with direct deposit is the fastest option available in 2026. It reduces manual handling and allows refunds to be sent directly to bank accounts. Paper returns take longer because they must be processed by hand, and refunds issued by check may take six weeks or more to arrive.

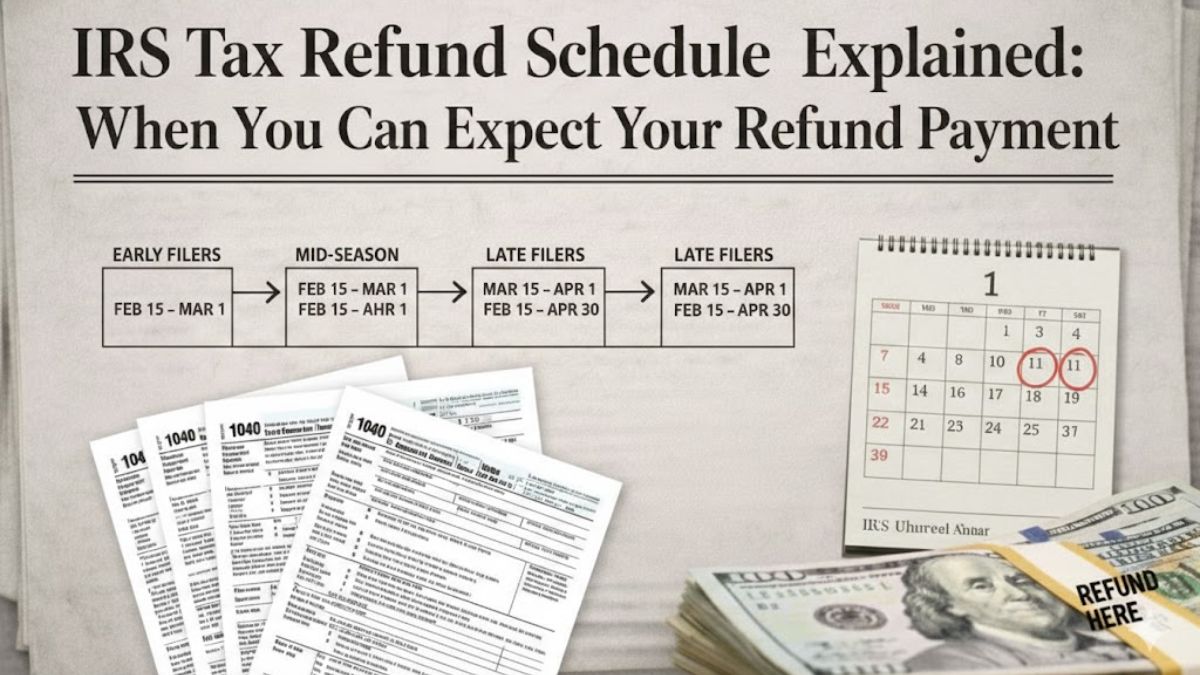

Early Filers and February Refunds

Taxpayers who file early and meet all requirements often receive refunds during February. Many electronic filers see refunds in the first half of the month, while others may receive them later depending on acceptance dates. The key factor is when the IRS accepts the return, not when it is submitted.

Credits and Common Reasons for Delays

Refunds that include refundable tax credits, such as the Earned Income Tax Credit or the Additional Child Tax Credit, may take longer due to mandatory verification rules. Other delays can result from errors in personal information, incorrect bank details, missing forms, or identity verification requests. Reviewing all details before filing helps reduce these risks.

Tracking Your Refund Safely

The IRS provides official tools that allow taxpayers to monitor refund progress. These tools show when a return is received, approved, and sent for payment. Updates are made daily and offer the most accurate information available. Bank processing times may cause short delays even after the IRS issues a refund.

Planning Ahead for a Smoother Experience

Filing early, choosing electronic submission, and opting for direct deposit remain the best ways to receive refunds faster in 2026. Double-checking information before submission and planning how to use the refund can also make the waiting period easier.

Overall, most taxpayers can expect refunds within three weeks of acceptance if their returns are straightforward. Understanding the process helps taxpayers navigate the season with confidence and realistic expectations.

Disclaimer:

This article is for general informational purposes only and does not provide legal, financial, or tax advice. Tax laws, refund timelines, and eligibility rules may change. Taxpayers should rely on official IRS guidance or consult a qualified tax professional for advice specific to their situation.