Many taxpayers are feeling confused and frustrated in February 2026 as refund deposits expected around $2,000 are arriving at different times than usual. In past years, refunds often followed predictable schedules, making it easier to estimate when money would appear in bank accounts. This year, however, deposit timing feels inconsistent, leaving many people uncertain about what is happening with their refund.

Why Refund Timing Feels Different in February 2026

The main reason for this confusion is a change in how federal refund processing works. The Internal Revenue Service is handling extremely high filing volumes while also applying stricter verification rules. Instead of releasing refunds in large batches on fixed dates, payments are now issued only after each individual return fully clears all review steps. This means refunds are no longer tied to a single predictable window.

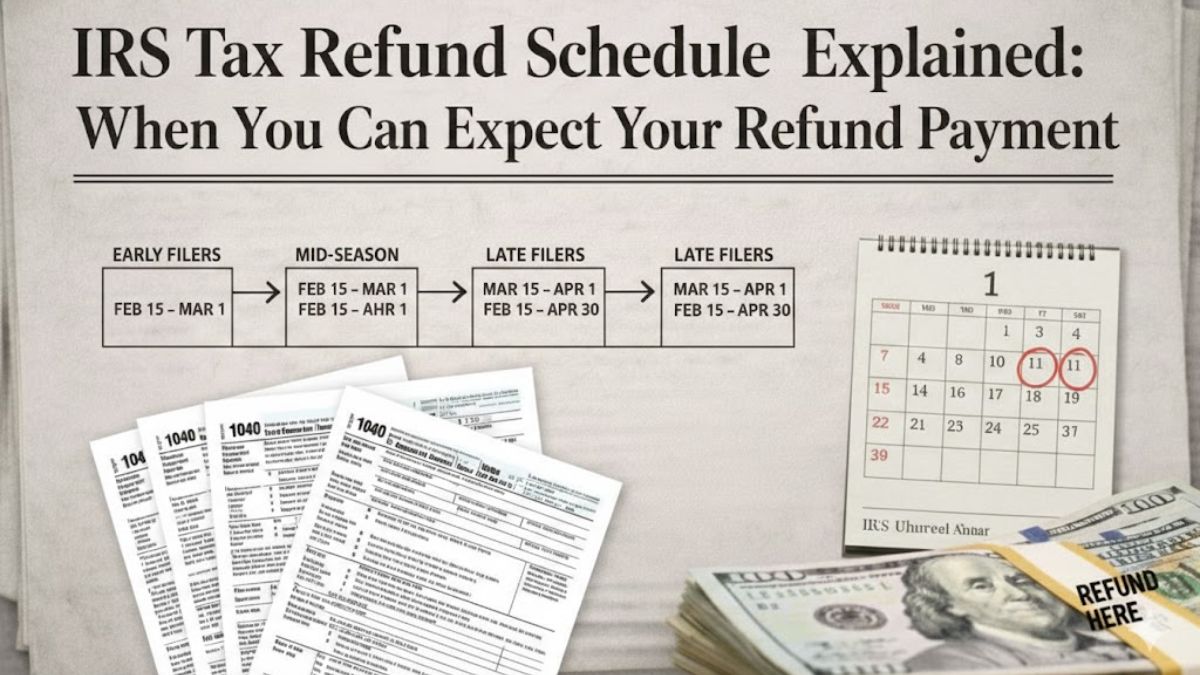

How the New Processing Flow Works

Every tax return goes through multiple checks before a refund is released. These checks confirm identity, income details, withholding amounts, and eligibility for credits. If all information matches perfectly, the return moves quickly through the system and the refund can be deposited sooner. If even one item requires extra review, the payment is temporarily paused until that step is completed. This review-based system naturally creates variation in deposit timing.

Why Some Refunds Arrive Faster Than Others

Returns filed electronically with direct deposit and accurate information tend to move through the system faster. These returns often avoid manual reviews and data mismatches. On the other hand, returns that include refundable credits, income changes, or missing documentation may require additional verification. This does not mean something is wrong, only that the return needs more time before approval.

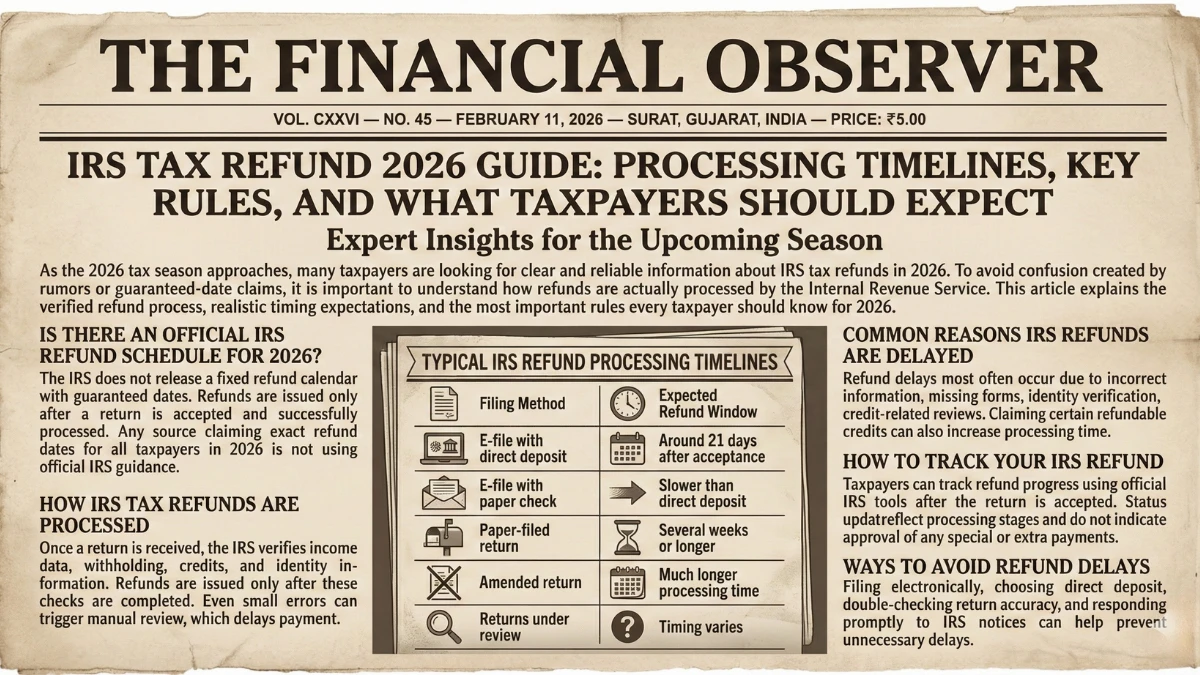

Why Comparing Refund Dates Can Be Misleading

Many taxpayers become worried when they see others receive refunds earlier. However, comparing timelines can increase stress because each return follows its own verification path. Two people who filed on the same day can receive refunds weeks apart due to differences in income, credits, or review requirements. Refund timing is now based on completion of checks rather than filing order alone.

What Taxpayers Should Do Next

The best approach is to track refund progress using official refund status tools rather than relying on estimated dates. These tools show whether a return has been received, approved, or sent. Ensuring accurate filing, complete documentation, and correct banking details remains the most effective way to avoid delays. Patience is also important, as reviews are part of normal processing.

Understanding the Bigger Picture

Refund deposits in February 2026 feel unpredictable because processing systems have shifted toward verification-based releases instead of fixed schedules. Once a return clears all checks, payment follows. Understanding this change helps taxpayers manage expectations and reduce unnecessary worry during tax season.

Disclaimer: This article is for informational purposes only and does not provide tax or financial advice. Refund deposit timelines depend on official processing systems and individual filing details. Taxpayers should verify updates through authorized government sources or consult a qualified tax professional.