February 2026 is an important month for millions of Americans who rely on retirement or disability benefits as a steady source of income. As deposit dates get closer, many beneficiaries are checking their bank accounts and calendars to make sure they know when payments will arrive and how recent changes may affect the amount they receive. Having a clear understanding of the payment schedule and adjustments can help people stay financially prepared.

How Social Security Payments Are Managed

All retirement and disability benefits are issued by the Social Security Administration. Payments follow a fixed monthly system that has been in place for years. The timing of each deposit depends on two main factors: when a person first started receiving benefits and their date of birth. This system helps spread payments evenly throughout the month and keeps processing smooth.

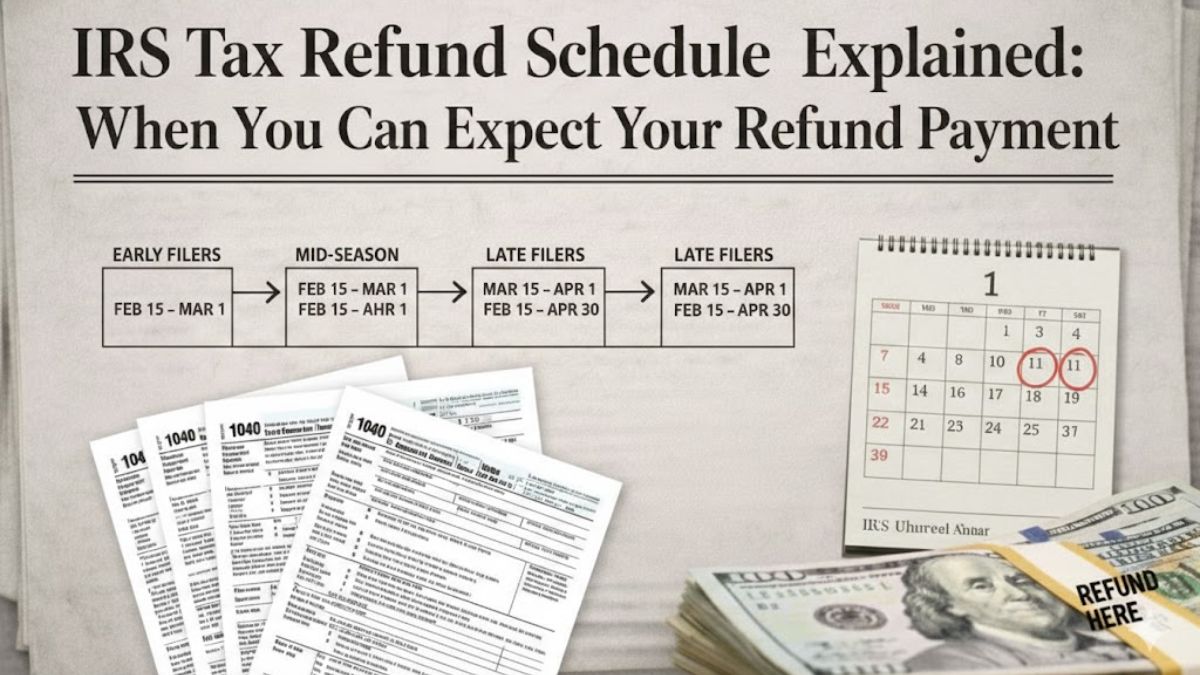

February 2026 Payment Dates Explained

For beneficiaries who began receiving Social Security benefits before May 1997, payments usually arrive at the beginning of the month. For most other recipients, February payments are scheduled based on birth dates. Those born early in the month typically receive payments earlier, while those with later birthdays receive payments later in February. Social Security Disability Insurance payments generally follow the same schedule unless the individual also receives Supplemental Security Income, which can change timing slightly.

No Confirmed Stimulus Check in February 2026

Despite online discussions and social media rumors, there is currently no confirmed universal federal stimulus check planned for February 2026. Any new nationwide payment would require approval from Congress and an official announcement. Beneficiaries should rely only on verified government information and avoid unconfirmed claims that can cause unnecessary confusion.

COLA Increase Reflected in February Deposits

The annual Cost of Living Adjustment takes effect starting in January, which means February payments already include the updated benefit amount. This adjustment is designed to help offset inflation and rising costs for everyday necessities such as food, housing, utilities, and healthcare. The exact increase each person receives depends on their individual benefit amount, as the adjustment is applied as a percentage rather than a flat dollar figure.

Medicare Deductions and Net Payment Amount

Some beneficiaries may notice that their net deposit is not as high as expected. This can happen when Medicare Part B premiums are deducted directly from Social Security payments. If premiums increase, they can reduce part of the benefit increase. Reviewing the benefit statement helps explain how deductions affect the final deposited amount.

Staying Informed and Avoiding Scams

Beneficiaries can log into their official Social Security account online to confirm payment dates and benefit details. Direct deposit remains the fastest and safest way to receive funds. It is also important to stay alert for scams, as fraud attempts often rise when payment news circulates. The SSA does not contact beneficiaries to request personal information or fees.

Final Thoughts on February Payments

February 2026 Social Security and SSDI payments will follow the standard schedule and reflect COLA adjustments. Staying informed through official sources helps ensure peace of mind and financial readiness.

Disclaimer: This article is for informational purposes only and does not provide financial or legal advice. Payment amounts and schedules depend on individual eligibility and official Social Security Administration guidelines. Beneficiaries should confirm details through SSA’s official website or customer service channels.