As February 2026 approaches, online discussions about a possible $2,000 payment from the Internal Revenue Service have increased sharply. Many taxpayers are trying to understand whether this amount refers to a new stimulus check, a special credit, or a regular tax refund. Because financial news spreads quickly and often without full context, it is important to look at what is officially confirmed and what is not.

Is There a New $2,000 IRS Stimulus in February 2026

At this time, there is no officially confirmed nationwide $2,000 stimulus payment scheduled for February 2026. Congress has not approved a new federal stimulus program, and the IRS has not announced any universal payment that would automatically go to all Americans. If such a program were approved, it would be clearly announced with defined eligibility rules, payment dates, and funding details.

Why the $2,000 Amount Is Being Discussed

The $2,000 figure is appearing frequently because it matches a common range for tax refunds and credit-related payments. For many taxpayers, refunds based on 2025 tax returns often fall near this amount. In some cases, the figure may represent recovery of previously unclaimed credits, child-related tax benefits, Earned Income Tax Credit adjustments, or even certain state-level relief payments. These are not new stimulus checks but outcomes of individual tax situations.

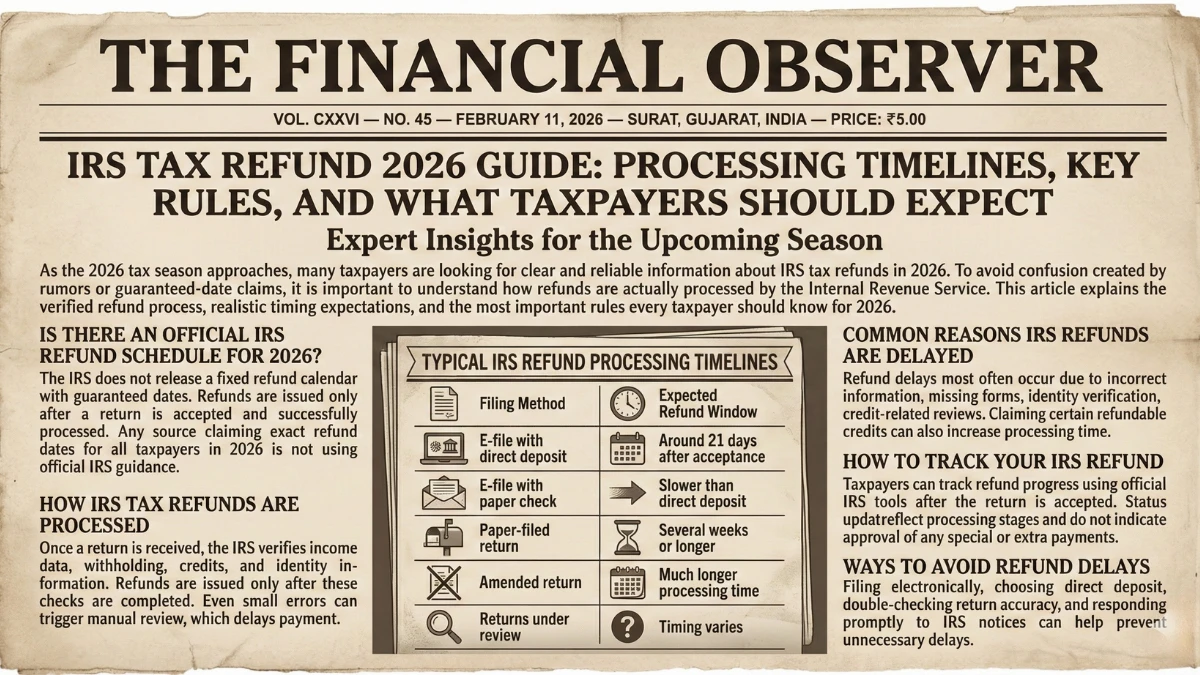

How IRS Refund Payments Usually Work

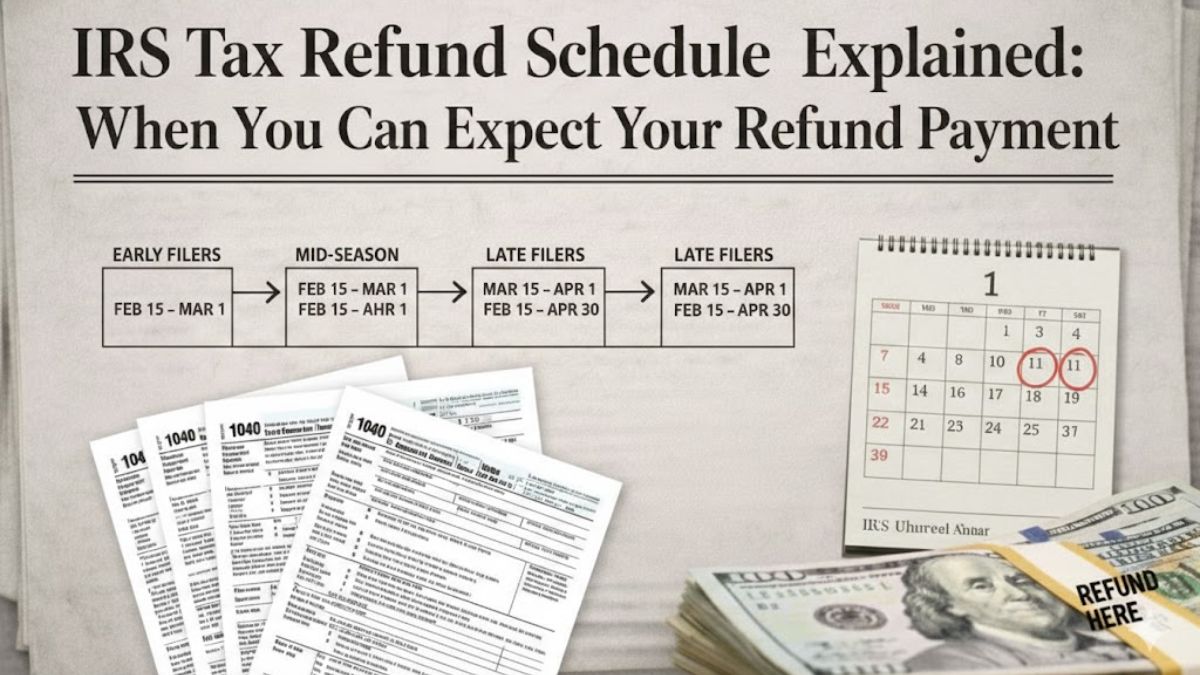

If the $2,000 amount refers to a regular federal tax refund, the payment timing depends on when and how a return is filed. Taxpayers who file electronically and choose direct deposit usually receive refunds within about 21 days after the return is accepted. Early filers often see deposits arrive during February. Those who request paper checks generally wait longer due to printing and mailing time.

Who May Receive a Refund Near $2,000

Refund amounts are calculated individually. Factors such as annual income, filing status, taxes withheld during the year, number of dependents, and refundable credits all affect the final amount. Families with dependents or taxpayers eligible for refundable credits may receive higher refunds. There is no automatic $2,000 payment without meeting tax or credit requirements.

How to Track Payments Safely

After filing a tax return, taxpayers can track refund progress using the IRS’s official online refund tracking tool. This shows whether a return has been received, approved, or sent. It is important to rely only on official government platforms. Any website or message promising guaranteed early payments should be treated with caution.

Avoiding Confusion and Scams

Financial assistance rumors often spread quickly, especially when large dollar amounts are mentioned. However, not every headline reflects a confirmed federal program. The safest approach is to verify information through official IRS announcements rather than social media claims or forwarded messages.

Final Understanding for February 2026

There is currently no confirmed universal $2,000 IRS payment for February 2026. In most cases, this amount refers to tax refunds or credit-based payments that depend on individual eligibility. Filing accurately, choosing direct deposit, and relying on official updates remain the best ways to avoid confusion.

Disclaimer:

This article is for informational purposes only. Payment amounts, eligibility, and deposit dates depend on individual tax situations and official government approval. Readers should consult the IRS website or a qualified tax professional for accurate and personalized guidance.