As February 2026 moves forward, many people are searching online for news about a possible $2,000 IRS direct deposit. Social media posts and viral messages have increased confusion, leading taxpayers to wonder if a new federal payment has been approved. It is important to separate confirmed facts from online speculation before expecting any deposit.

No Confirmed $2,000 IRS Stimulus Payment

As of now, there is no official announcement from the federal government or the Internal Revenue Service confirming a universal $2,000 stimulus payment for all Americans in February 2026. No new legislation has been passed, and no federal agency has released guidance approving such a nationwide payment. Claims suggesting that everyone will receive a $2,000 IRS deposit are not supported by verified information.

Why Some People May See Deposits Near $2,000

Although there is no new stimulus program, some individuals may still receive deposits close to $2,000 through normal financial processes. The IRS is currently handling tax returns for the 2026 filing season, which covers income earned during the previous year. Refund amounts differ for each taxpayer and depend on income level, withholding, and tax credits.

Certain households qualify for refundable credits that can significantly increase their refund. Credits related to children, work income, or education expenses may push a refund total above or near $2,000. These refunds are part of routine tax processing and should not be confused with special relief payments.

Other Federal Payments Causing Confusion

In some cases, people may notice deposits around $2,000 when different federal benefits are combined. Monthly payments from programs such as Social Security can reach that amount depending on retirement age, work history, and benefit type. These are scheduled benefit payments and are not connected to the IRS issuing a new stimulus deposit.

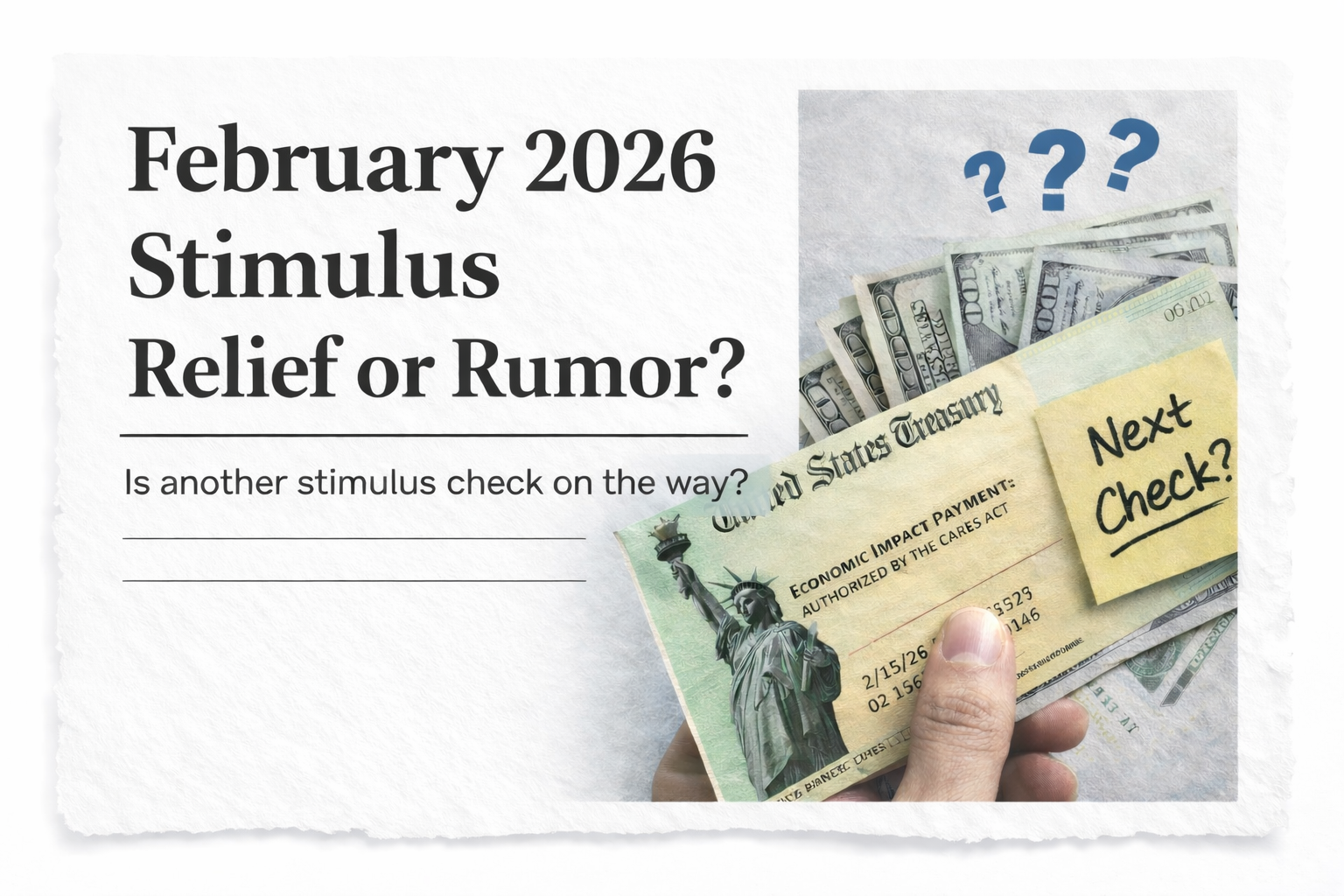

Understanding IRS Refund Timing

Tax refunds are issued after the IRS reviews and approves a return. Processing time depends on how accurate the return is, whether credits are being reviewed, and the overall workload of the agency. Refund status can be checked using the official refund tracking tool on the IRS website. This tool updates daily and shows whether a return has been received, approved, or sent.

Beware of Online Misinformation and Scams

False claims about guaranteed IRS payments often spread quickly online. Scammers may use this confusion to send fake messages asking for personal or banking information. The IRS does not charge fees to release refunds and does not request sensitive details through unsolicited emails or messages.

What Taxpayers Should Expect

While IRS refunds are being issued during February 2026 and some may total around $2,000, there is no confirmed universal $2,000 IRS direct deposit program. Taxpayers should rely only on official IRS tools and announcements for accurate updates during tax season.

Disclaimer

This article is for informational purposes only and does not provide legal, tax, or financial advice. Federal programs, refund rules, and payment amounts may change based on official government decisions. For the most accurate and up-to-date information, consult official IRS resources or a qualified tax professional.