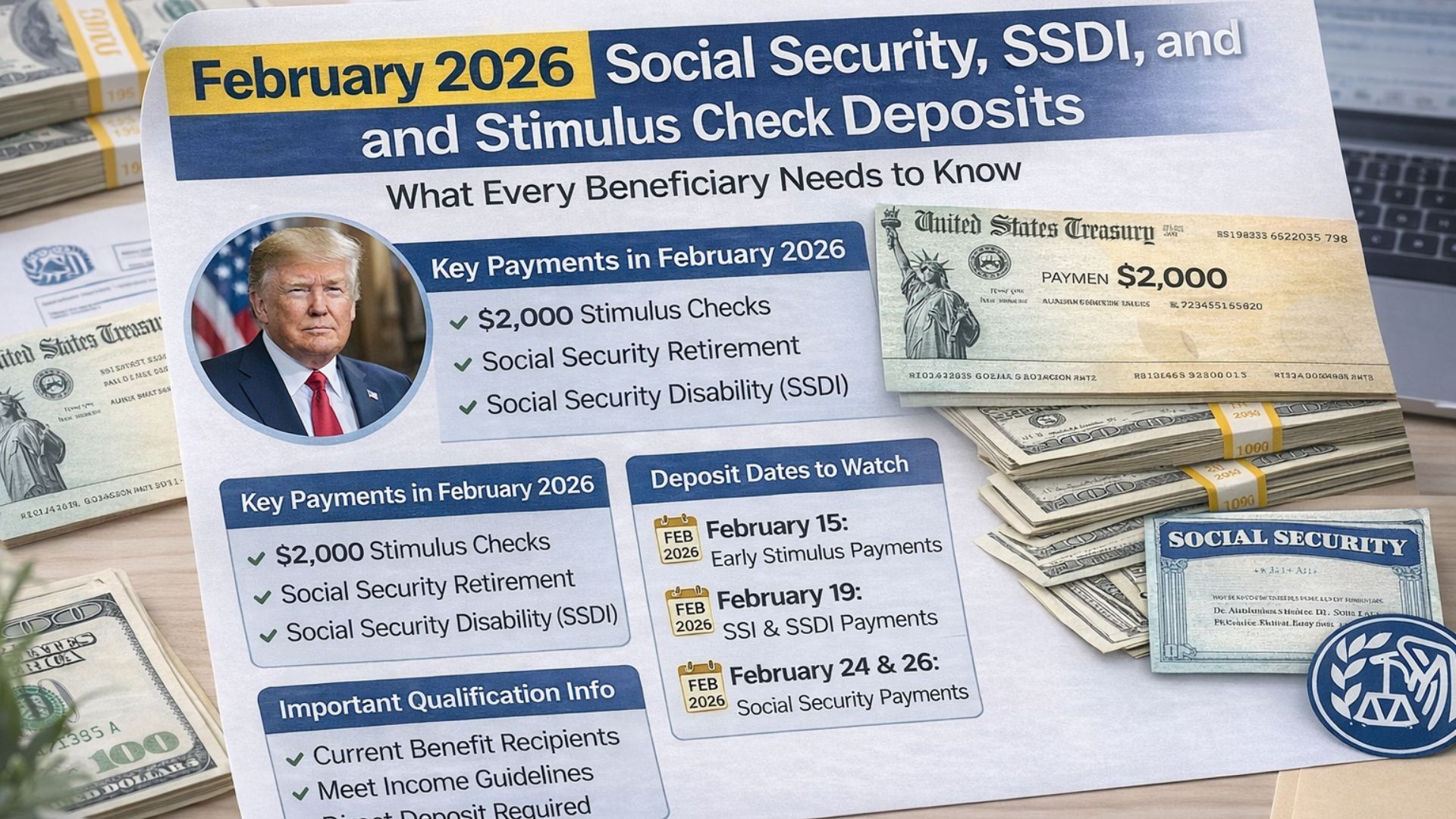

February 2026 is becoming an important month for millions of Americans who rely on federal benefit payments to manage daily expenses. Social Security and SSDI payments are already scheduled, and ongoing discussions about a possible $2,000 stimulus payment have added to public attention. For retirees, people with disabilities, and low- to middle-income households, these deposits often decide how comfortably they can cover rent, medical costs, and food bills.

Social Security Payment Schedule for February 2026

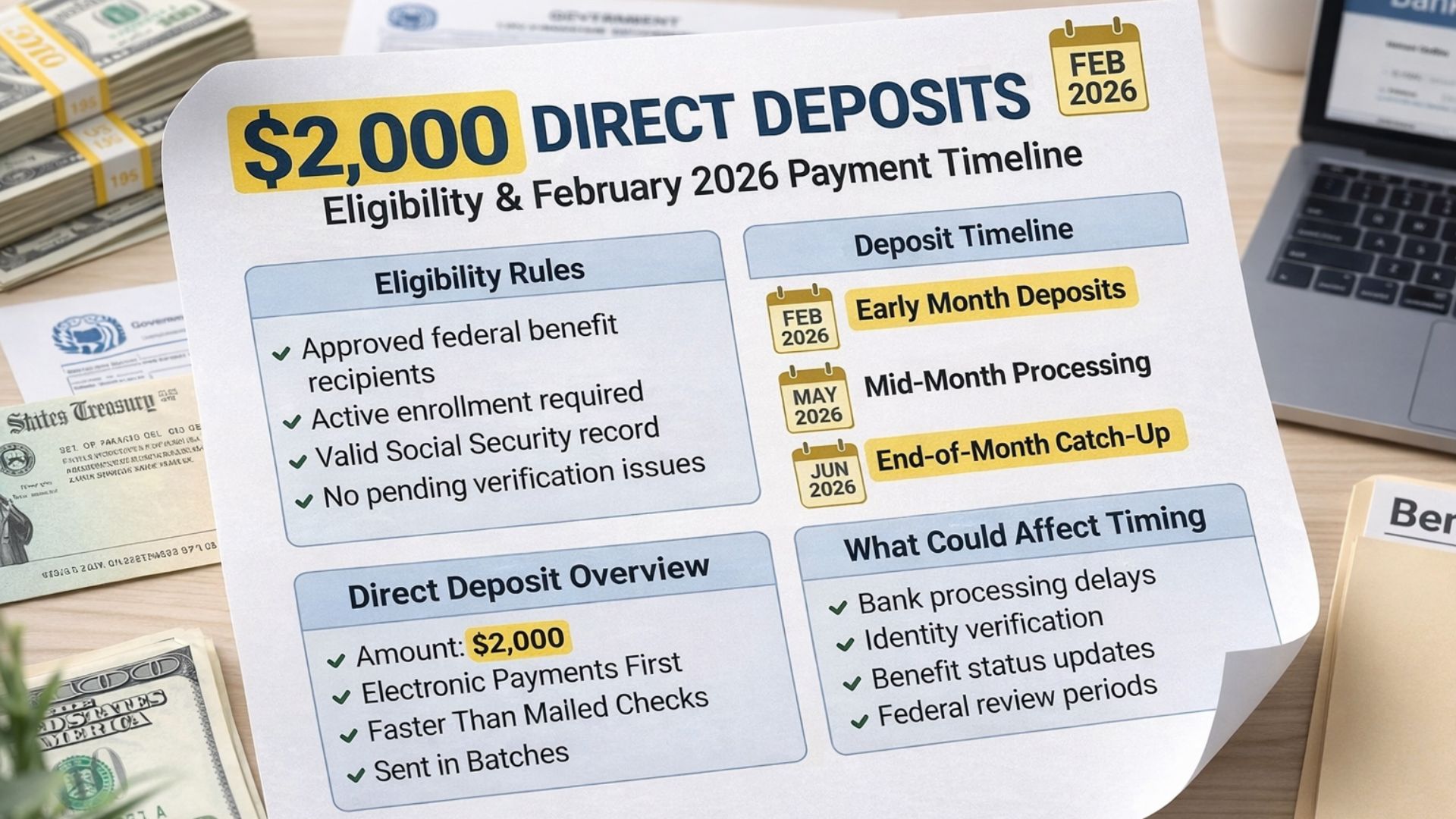

Social Security payments follow a well-established system based on the beneficiary’s birth date. This schedule helps the Social Security Administration process payments smoothly and avoid system overload. People born between the 1st and 10th usually receive their money on the second Wednesday of the month. Those born between the 11th and 20th are paid on the third Wednesday, while the remaining group is paid on the fourth Wednesday. In February 2026, this pattern is expected to remain the same unless an unexpected federal holiday causes a change.

SSDI Payments and Special Cases

SSDI recipients generally follow the same deposit calendar as retirement beneficiaries. However, individuals who started receiving benefits before May 1997 or those who also qualify for SSI may see different payment timings. These variations can cause confusion, which is why checking official benefit statements is important. Direct deposit continues to be the fastest and safest method, while paper checks may face mailing delays.

$2,000 Stimulus Check Discussions

Talk about a possible $2,000 stimulus payment has spread quickly online. While many beneficiaries are hopeful, experts stress that no payment is guaranteed without official approval. The Internal Revenue Service would manage eligibility using recent tax return data, including income limits and filing status. In past programs, people with updated direct deposit information received payments first, while paper checks took longer.

Why February Payments Matter

February often brings financial pressure due to higher utility bills, healthcare costs, and post-holiday expenses. When federal payments arrive on time, they provide relief not only to households but also to local businesses, as spending typically increases soon after deposit days.

Staying Prepared and Informed

The best approach is preparation rather than speculation. Beneficiaries should ensure their bank details are current and regularly check official government portals for updates. Accurate tax filings and realistic budgeting can reduce stress if delays occur.

Disclaimer: This article is for informational and journalistic purposes only. Payment schedules, eligibility rules, and any stimulus approvals are subject to official confirmation by the Social Security Administration, the Internal Revenue Service, and the U.S. Department of the Treasury. Readers should rely only on official government sources before making financial decisions.