As February 2026 approaches, many taxpayers across the United States are paying close attention to news about a possible $2,000 IRS direct deposit. This payment has been discussed as part of federal financial support efforts designed to help eligible individuals and households manage rising living costs. Understanding how the payment works, who may qualify, and how it will be delivered can help people avoid confusion and delays.

Overview of the $2,000 IRS Payment

The $2,000 payment is intended for eligible taxpayers who meet specific federal requirements. It is not a universal payment for everyone, but rather a targeted benefit connected to tax filings, income limits, and certain credits or relief programs. The IRS plans to issue these payments primarily through direct deposit to ensure faster and more secure delivery. For those without banking information on file, other payment methods may apply.

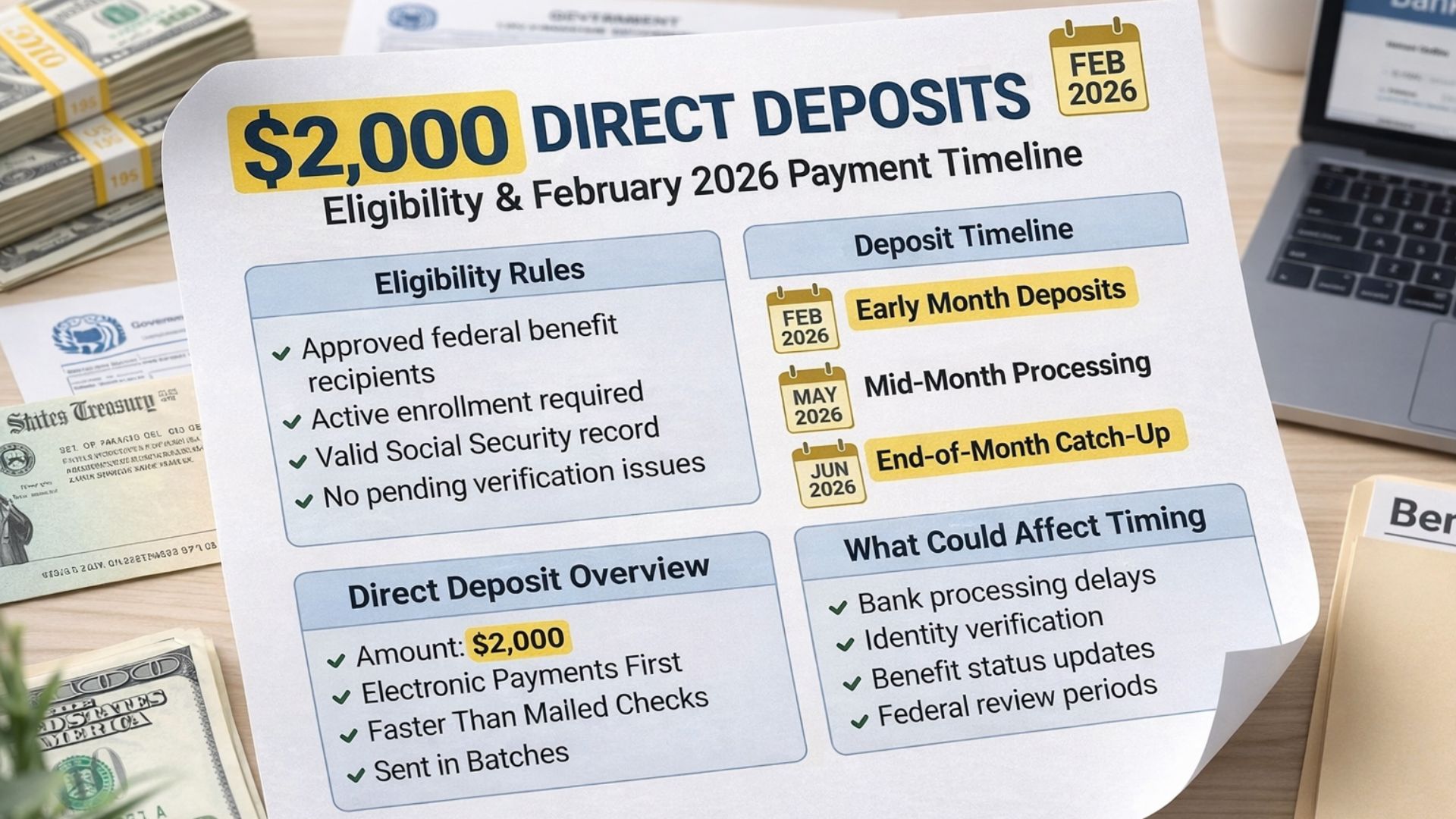

Eligibility and Filing Requirements

Eligibility for the $2,000 payment depends largely on income thresholds and proper tax filing. Individuals and households must have filed required tax returns and provided accurate personal information, including valid Social Security numbers. Taxpayers who claim refundable credits or qualify under specific federal relief provisions may also fall within the eligible group. Filing early and ensuring all information is correct increases the chances of smooth processing.

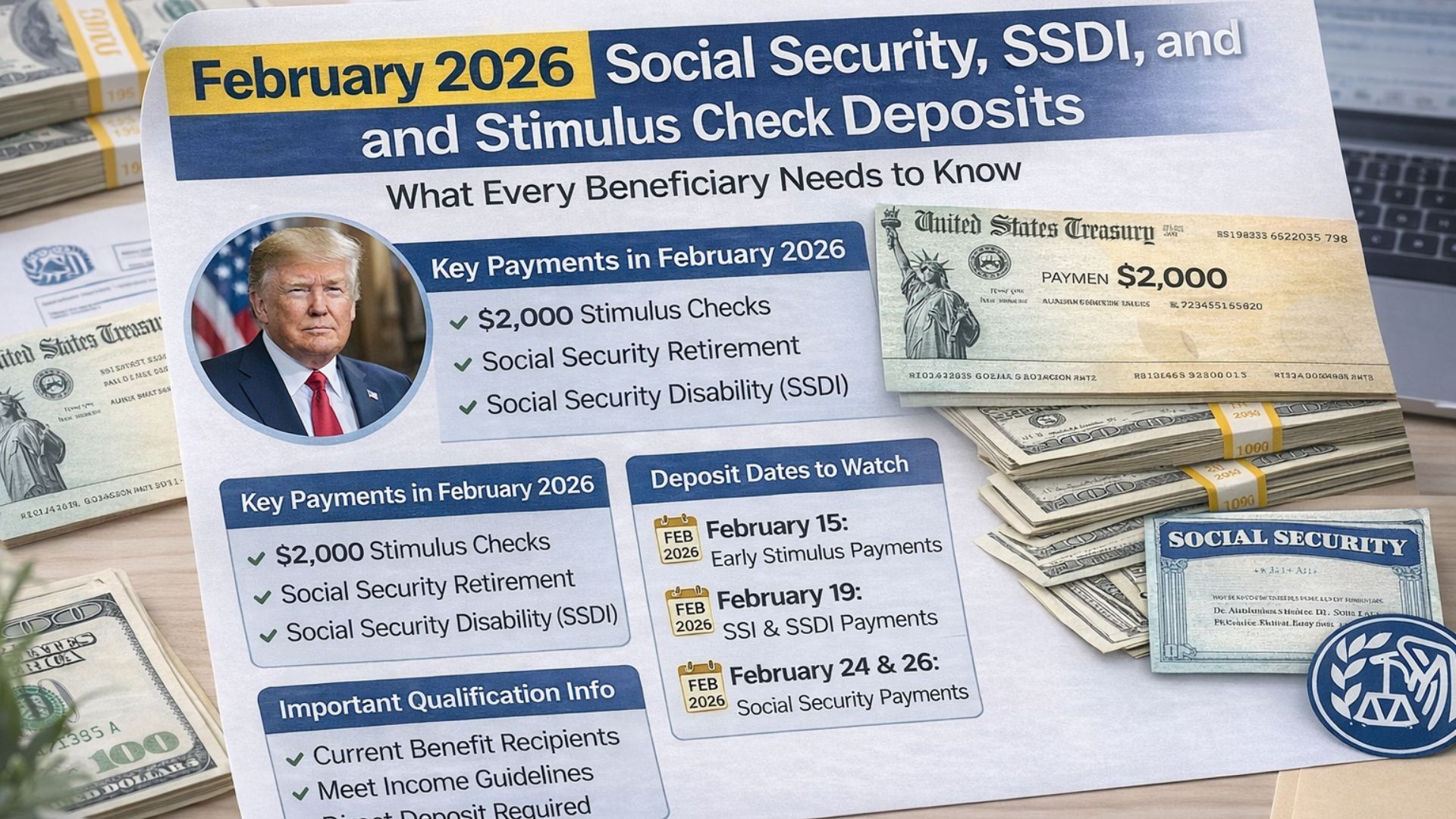

Payment Schedule and Delivery Methods

The IRS has scheduled these payments for February 2026. Direct deposits are expected to be processed first, allowing many recipients to receive funds quickly. Those who receive payments by mailed check or prepaid debit card may experience slightly longer wait times due to postal delivery and additional processing steps. Choosing direct deposit remains the most reliable way to receive funds without unnecessary delays.

Possible Delays and Common Issues

While many payments are expected to arrive on time, some taxpayers may face delays. Incorrect bank account details, pending eligibility checks, or amended tax returns can slow down processing. Claims involving special credits or adjustments may also require extra review. Keeping personal and banking information up to date with the IRS helps reduce the risk of delays.

Tracking Your Payment Status

Taxpayers can track the status of their payment using official IRS tools such as the “Where’s My Refund?” portal or the IRS mobile app. By entering basic details like Social Security number, filing status, and expected payment amount, recipients can see updates and better plan their finances for the month.

Final Thoughts

The $2,000 IRS direct deposit scheduled for February 2026 can provide meaningful financial relief for eligible taxpayers. Staying informed, filing taxes accurately, and monitoring payment status are key steps to ensuring timely receipt of funds. Proper preparation can make the process smoother and help households manage essential expenses more effectively.

Disclaimer: This article is for informational purposes only. IRS payment amounts, eligibility rules, and payment dates are subject to change based on official IRS announcements and individual tax circumstances. Always refer to official IRS sources for the most accurate and up-to-date information.