As February 2026 draws closer, many taxpayers across the United States are seeing online claims about a $2,000 IRS direct deposit. Some sources describe it as automatic for everyone, while others suggest fixed payment dates or extra bonuses. This confusion makes it important to separate verified information from speculation so people can plan correctly and avoid scams.

Understanding the February 2026 IRS Direct Deposit

The Internal Revenue Service has confirmed that certain direct deposits may begin arriving in February 2026. These payments are not random or universal. They are tied to verified tax filings and are processed as part of existing federal tax and assistance-related programs. Any official confirmation always comes directly from the IRS or the U.S. Department of the Treasury, not from social media posts or third-party websites.

Who May Be Eligible for the $2,000 Payment

Eligibility for the $2,000 deposit depends on several factors reviewed during tax processing. Income level, filing status, and prior participation in certain federal assistance or credit programs all play a role. Taxpayers who meet the required thresholds and whose information is fully verified may receive the payment automatically. Those who do not qualify will not receive a deposit, even if online claims suggest otherwise.

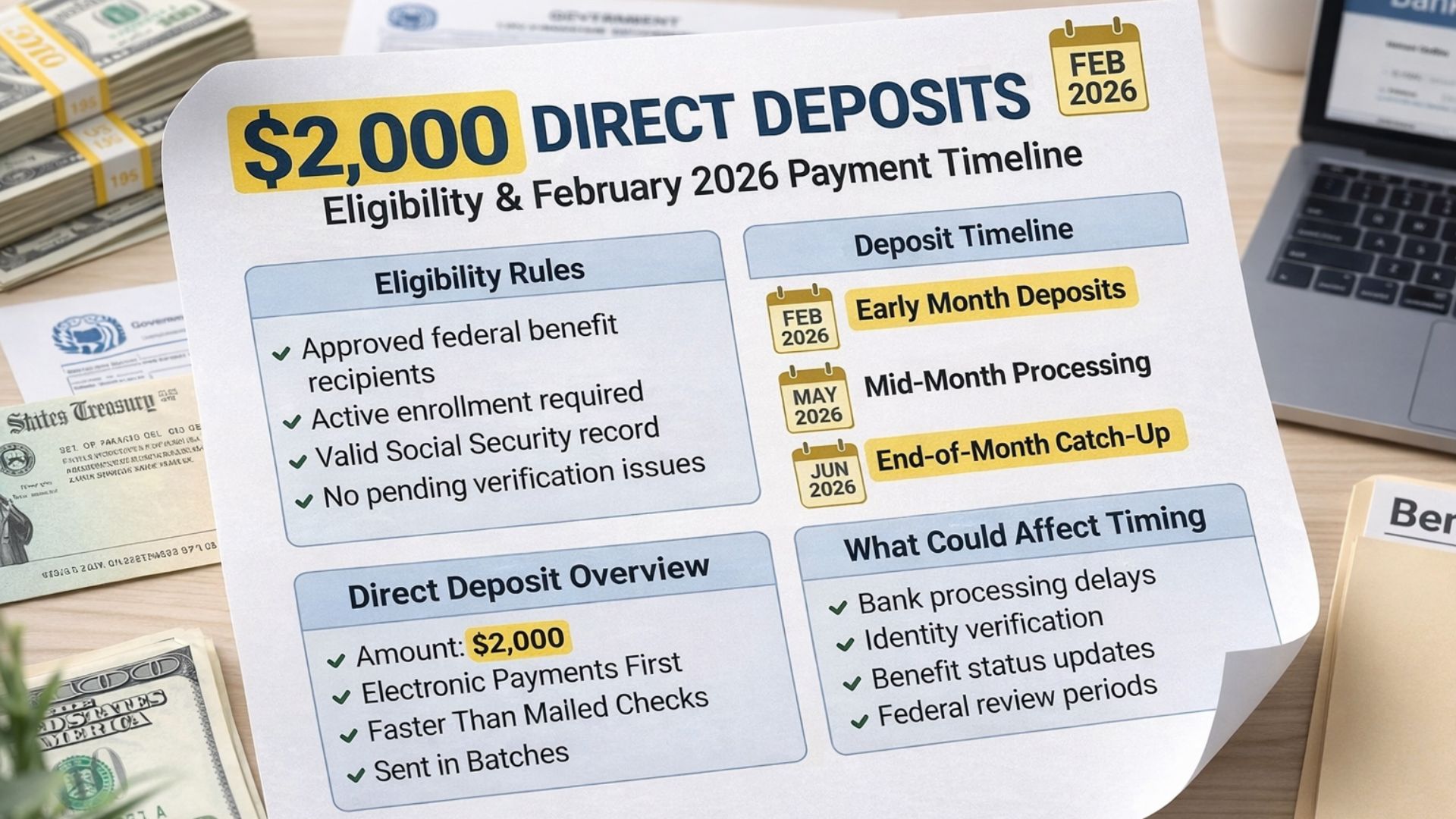

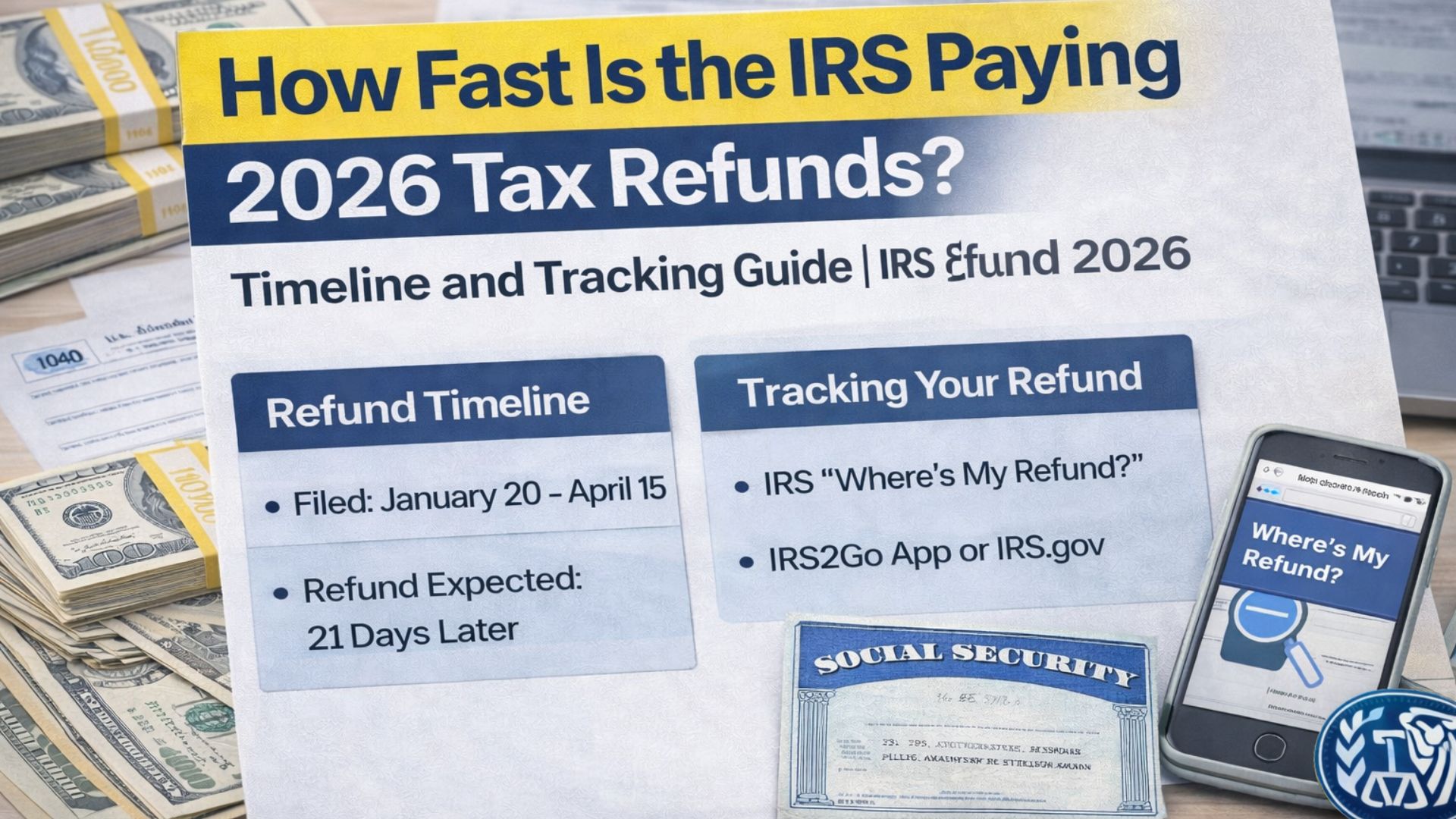

Payment Timing and How Deposits Are Issued

Although February 2026 is the expected starting window, the exact deposit date can differ from person to person. Processing speed depends on how and when a tax return was filed, whether direct deposit details are on record, and if additional verification is needed. Some payments may arrive early in the month, while others may be delayed into later weeks without any issue.

Avoiding Online Rumors and Misinformation

A common rumor suggests that every taxpayer will receive $2,000 on a single fixed date. This is incorrect. Only eligible individuals receive the payment, and timing varies. The IRS advises taxpayers to rely only on official tracking tools and announcements. Claims that promise faster processing or guaranteed approval in exchange for fees are false and should be avoided.

Steps to Ensure Smooth Processing

Accurate and up-to-date tax filings are essential for receiving any IRS payment. Bank account information must match IRS records to allow direct deposit. Taxpayers should regularly check official IRS portals for updates instead of relying on unofficial sources or viral posts.

Final Overview

The $2,000 IRS direct deposit expected around February 2026 is real, but only for eligible taxpayers. Understanding the rules, staying informed through official channels, and ignoring unverified claims can help ensure the process goes smoothly and safely.

Disclaimer: This article is for informational purposes only. Payment amounts, eligibility, and schedules may change based on official IRS and U.S. Treasury announcements.