Seeing the status “refund approved” can bring a real sense of relief for taxpayers. For many households, a tax refund is not just extra money. It helps pay overdue bills, reduce debt, build savings, or support important personal needs. Once a tax return is filed, the most difficult part is done. What follows is the waiting period, and understanding how the refund process works can make that wait much easier.

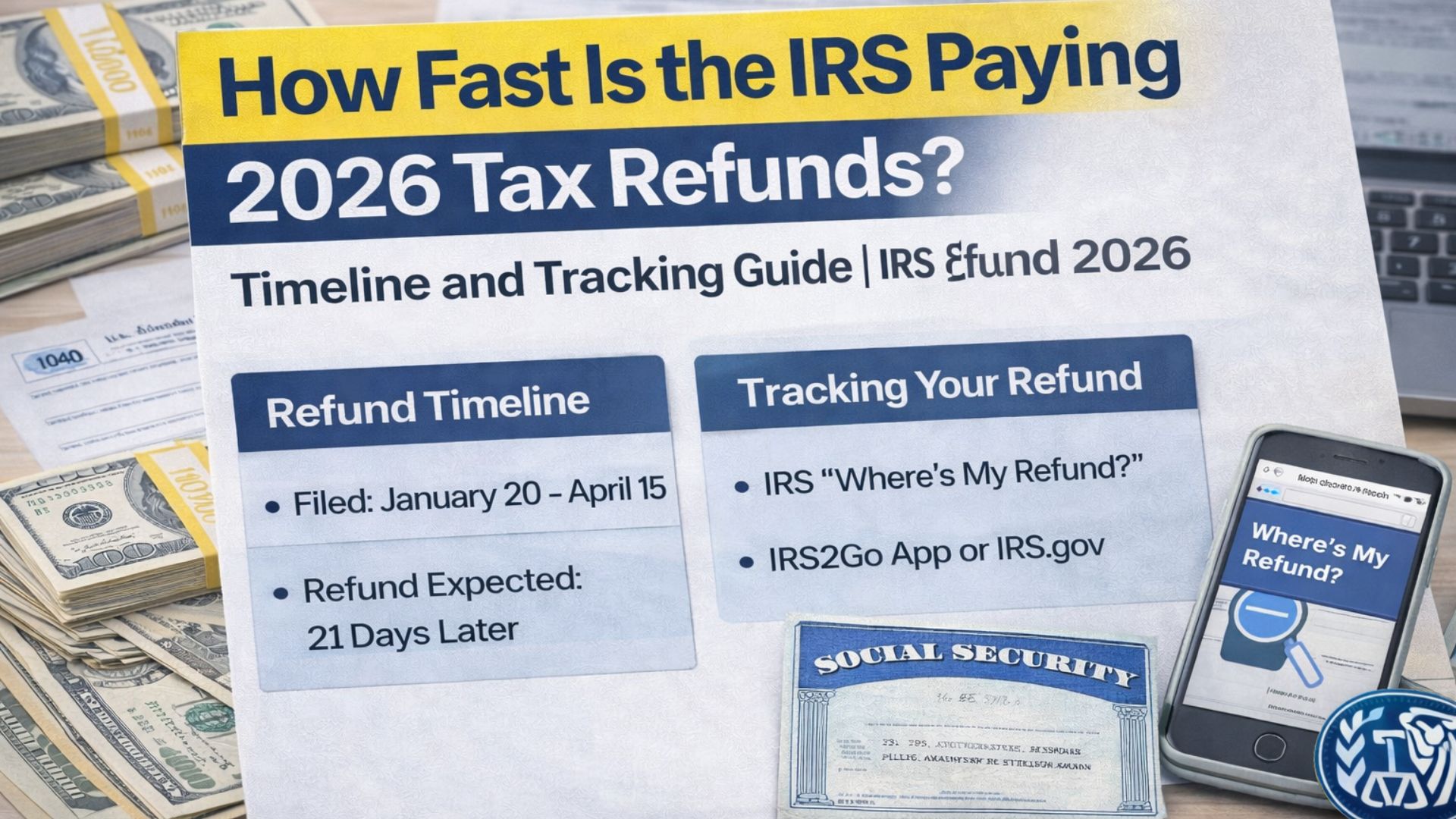

Why the 2026 IRS Refund Schedule Is Not Official Yet

As the 2026 tax season approaches, many taxpayers are searching for an official refund schedule. The Internal Revenue Service typically opens the tax filing season toward the end of January. Only after the season officially begins does the IRS finalize refund timelines. This is why an exact calendar has not yet been released. Even so, refunds are not unpredictable, as the IRS follows very similar processing patterns every year.

How Refund Timing Is Determined

The most important factor in refund timing is the date your return is accepted by the IRS, not the date you submit it. Once an electronic return is accepted, it enters the processing system. The IRS generally reviews returns in the order they are received, although some returns require additional checks. In most cases, refunds are issued within 21 days of acceptance, especially for electronic filers using direct deposit.

Filing Day and Processing Speed

The day of the week you file can slightly affect how quickly your refund moves through the system. Returns filed electronically early in the week often move through initial review faster. Once approved, direct deposits may reach bank accounts within a few business days. Returns filed later in the week may fall into the next processing cycle, which can push the refund date slightly later but still within the standard timeframe.

Tracking Your Refund Status

After filing, the “Where’s My Refund?” tool becomes the most reliable way to track progress. This tool updates once every 24 hours and shows whether your return is received, approved, or sent. When the status changes to “refund sent,” direct deposits usually arrive shortly after. Paper checks take much longer because of mailing and handling time.

Common Reasons for Refund Delays

Not all refunds move at the same pace. Paper returns take longer due to manual processing. Errors such as incorrect personal details or mismatched income information can trigger reviews. Refunds that include certain credits are also legally delayed until mid-February, even if the return is filed early.

Planning for a Smooth Refund Experience

Filing electronically, choosing direct deposit, and carefully reviewing your return before submission are the best ways to avoid delays. Planning in advance how you will use your refund can also make the waiting period feel more purposeful and less stressful.

Final Thoughts on the 2026 Refund Process

Although the official 2026 IRS refund schedule has not been released, the process is expected to follow familiar patterns. Most accurate, electronic filers should receive refunds within 21 days. Staying informed and patient helps ensure a smooth experience while waiting for your refund.

Disclaimer: This article is for informational purposes only and does not provide legal, financial, or tax advice. IRS refund timelines and processing rules may change based on official policy updates and individual circumstances. Always consult the official IRS website or a qualified tax professional for personalized guidance.