The IRS tax refund process for 2026 is an important topic for millions of taxpayers who rely on refunds to manage everyday expenses. As tax returns are filed, understanding how refunds are processed, how long they may take, and how to track their status can help reduce stress and financial uncertainty. The IRS has established systems and timelines that guide taxpayers through each stage of the refund cycle.

How the IRS Refund Process Works in 2026

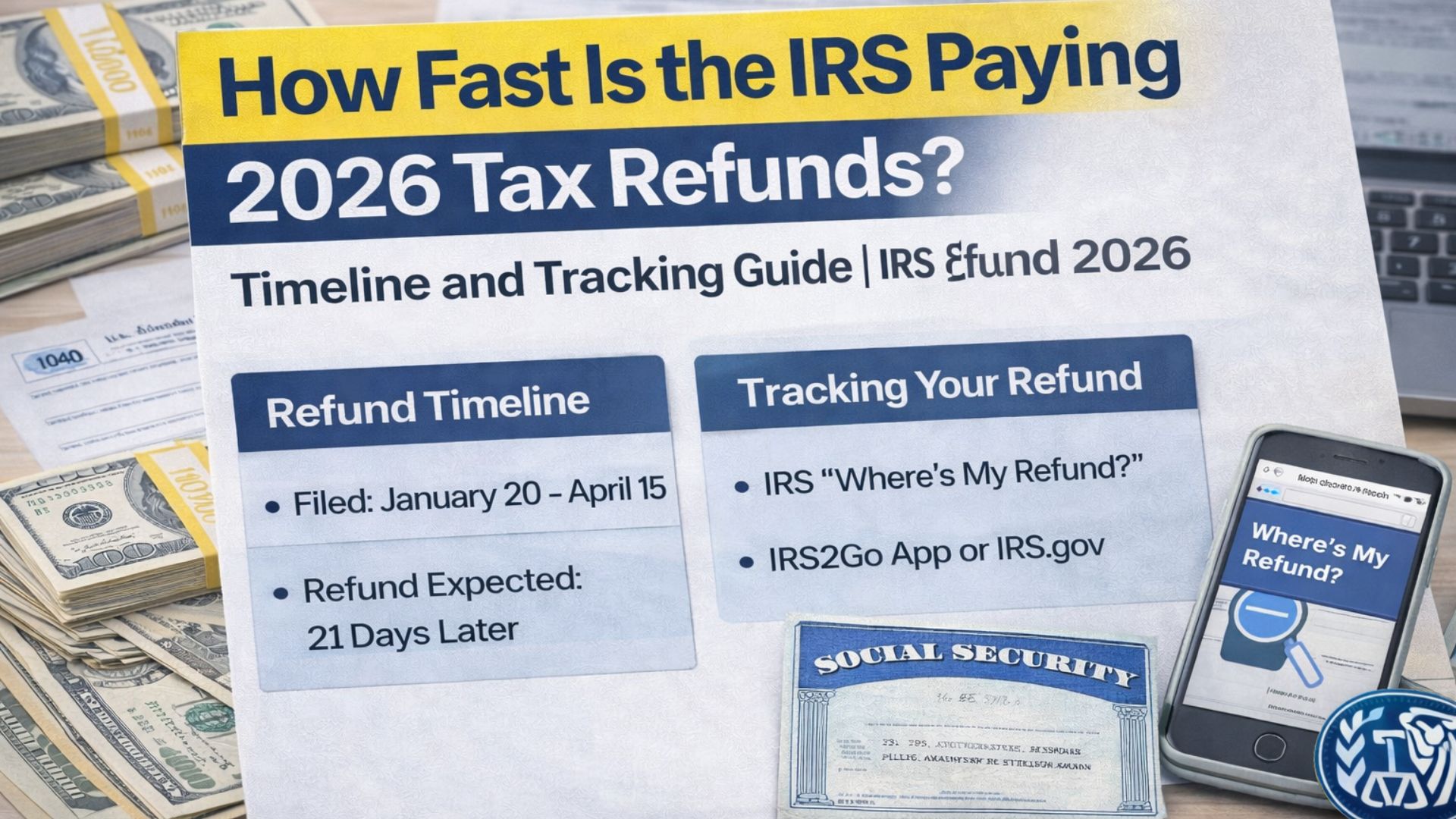

Once a tax return is submitted, the IRS begins reviewing it for accuracy and completeness. Electronically filed returns are handled first because they move through automated systems. In most cases, these returns are processed within 21 to 30 days if there are no errors or additional reviews required. Paper-filed returns usually take longer because they must be manually entered and reviewed, which can add several extra weeks to the process.

Factors That Affect Refund Timing

Refund timing can vary depending on several factors. Returns that require identity verification, income confirmation, or review of certain tax credits may take longer than average. Claims involving credits such as the Earned Income Tax Credit or Child Tax Credit often receive extra scrutiny to prevent fraud, which can slow down processing. Filing early and making sure all details are correct greatly improves the chances of receiving a refund on time.

How Refund Amounts Are Calculated

The amount of a tax refund depends on how much tax was paid during the year compared to the actual tax owed. Withholding amounts from wages, reported income from forms like W-2s and 1099s, and eligible deductions all play a role. Tax credits can significantly increase refund amounts when claimed correctly. Accurate reporting of income and credits is essential, as mistakes can lead to delays or adjustments.

Tracking Your Refund Status

The IRS offers online tools that allow taxpayers to check the progress of their refund. By entering basic information such as Social Security number, filing status, and expected refund amount, taxpayers can see whether their return has been received, approved, or sent for payment. These tools also notify users if additional information is needed, helping them take quick action if required.

Tips to Avoid Refund Delays

Filing early, choosing electronic filing, and selecting direct deposit are some of the most effective ways to avoid delays. Double-checking bank account details and personal information before submitting a return reduces the risk of errors. If the IRS contacts a taxpayer for clarification or documents, responding promptly can prevent further processing slowdowns.

Final Overview of the 2026 Refund Cycle

The IRS tax refund process for 2026 follows a structured system designed to deliver refunds efficiently while maintaining accuracy and security. Understanding timelines, tracking tools, and common delay causes allows taxpayers to plan better and stay informed throughout the tax season.

Disclaimer: This article is for informational purposes only. IRS refund timelines, processing rules, and payment details are subject to change based on official IRS guidance and individual tax situations. Always refer to official IRS sources for the most accurate and updated information.