As the tax season continues, many Americans are still waiting for their IRS tax refunds while others have already received their payments. This uneven timing has created confusion and concern, especially for households that rely on refunds to cover bills, pay down debt, or add to savings. Knowing why refunds are delayed and what to expect can help reduce stress and set realistic expectations.

Why Some IRS Refunds Are Taking Longer

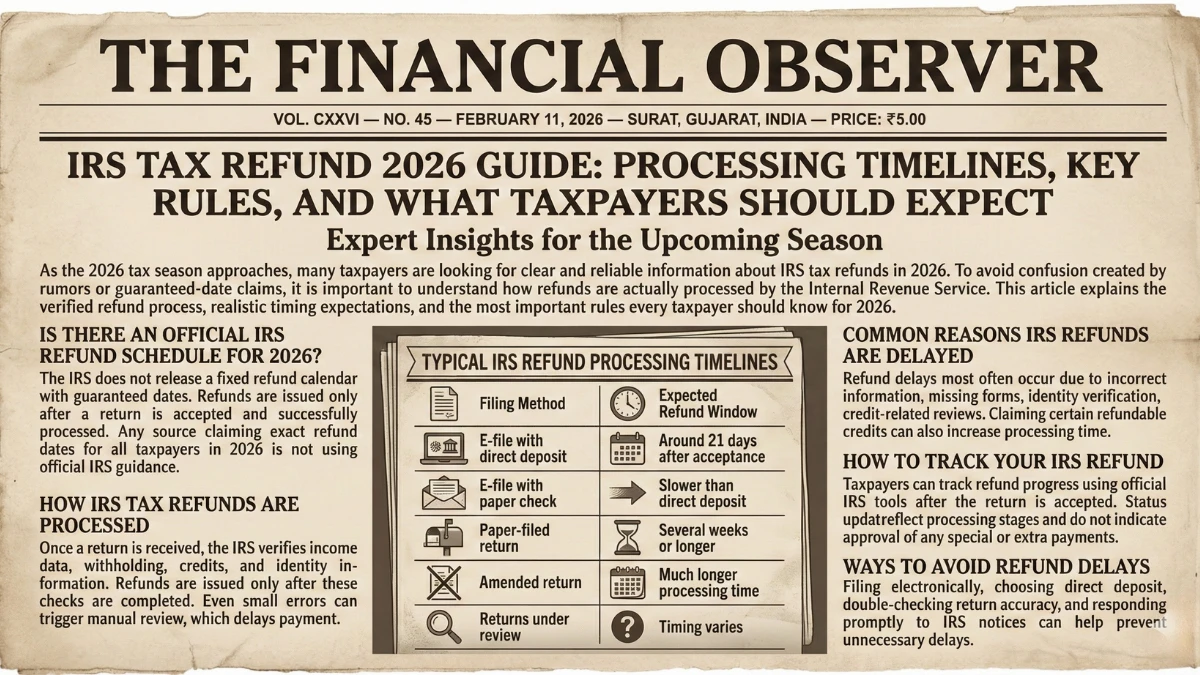

One of the main reasons for refund delays is increased verification. The IRS has strengthened fraud prevention measures, which means many returns are reviewed more carefully than before. Returns showing income mismatches, dependent-related questions, or identity concerns are often flagged for manual checks. Even a small detail that does not match IRS records can temporarily stop a refund from being released.

Refundable Credits Often Cause Extra Delays

Tax returns that include refundable credits are more likely to take longer to process. These credits require additional screening by law before payment is approved. Even if the return is filed early and correctly, the IRS may still hold the refund until all required checks are completed. This delay is common and does not necessarily mean there is a problem with the return.

High Filing Volume Slows Processing

As more taxpayers file during peak weeks, the IRS system handles a much larger workload. Electronic filing has improved overall speed, but high submission volume can still slow down processing. During busy periods, it may take longer for returns to move through review stages, especially if extra verification is required.

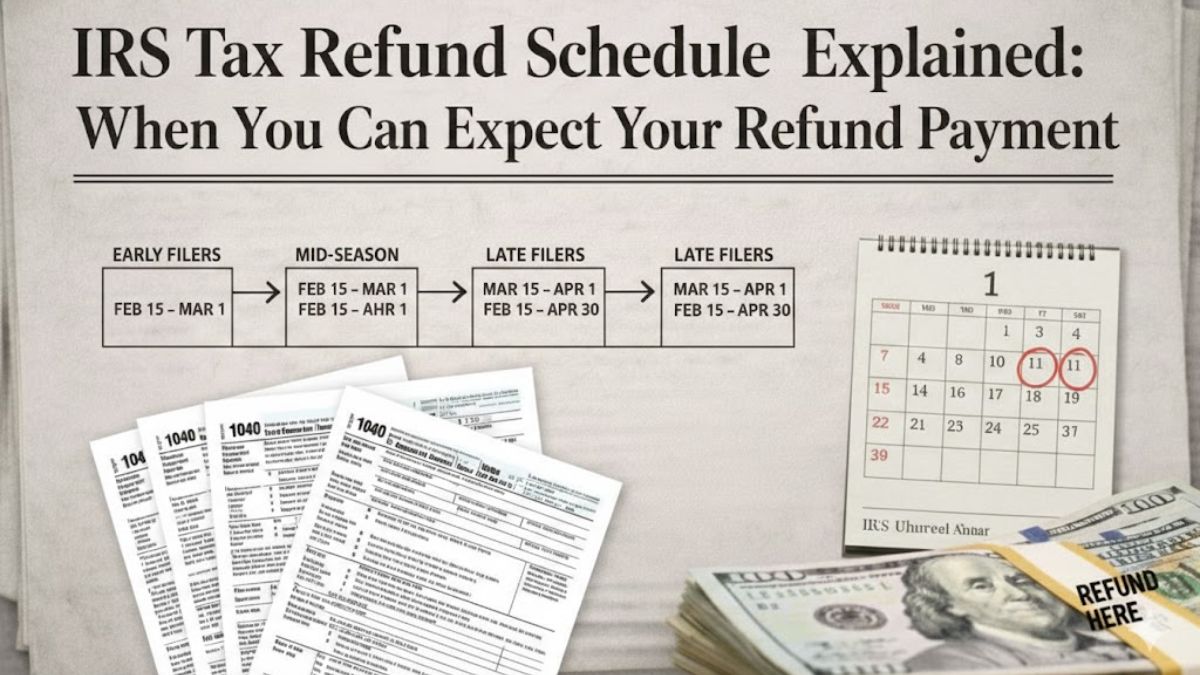

Filing Method Affects Refund Speed

Paper-filed returns remain the slowest option. These returns must be entered and reviewed manually, which adds significant time to the process. During peak tax season, paper refunds can take several weeks longer than electronic returns. Direct deposit remains the fastest and most reliable way to receive a refund once it is approved.

What the 21-Day Timeline Really Means

For most electronic filers, refunds are still issued within about 21 days after acceptance. If a return is under review, processing can take longer, but many delayed refunds are released automatically once checks are completed. If the IRS needs more information, it will send a notice by mail, and responding quickly can help avoid further delays.

How to Track and Respond to Delays

The IRS refund tracking system updates daily and shows whether a return has been received, approved, or sent. If the status does not change for several weeks, it usually means the return is being reviewed, not lost. If more than 21 days have passed, reviewing filing details and bank information is important. Filing an amended return without instruction can cause further delays.

Final Thoughts on IRS Refund Delays

IRS refund delays are affecting some taxpayers more than others due to verification checks, heavy filing volume, and paper returns. While many refunds still arrive within three weeks, some will take longer. Staying informed, tracking refund status, and responding promptly to IRS notices can help ensure payments arrive as soon as possible.

Disclaimer:

This article is for informational purposes only and does not constitute tax or financial advice. IRS refund timelines depend on individual tax returns and official processing rules. Always refer to IRS guidance or consult a qualified tax professional for personal advice.