The federal government has announced a one-time financial support payment commonly referred to as the 725 stimulus check for 2026. This payment is intended to provide relief to low- and middle-income households facing continued cost-of-living pressures. The program mainly relies on 2025 income records and benefit data to determine who qualifies and how payments are issued.

What the 725 Stimulus Check Means for 2026

The 725 stimulus check is designed as a single payment, not a recurring benefit. It is being administered through the Internal Revenue Service, using existing tax and benefit information already on file. The goal is to deliver funds efficiently without requiring most eligible individuals to take extra action.

Who May Qualify for the Payment

Eligibility is primarily based on adjusted gross income, filing status, and dependency rules. Adults who filed a 2025 tax return or who receive federal benefits such as Social Security are generally considered. Basic requirements usually include meeting age rules, maintaining U.S. residency for most of 2025, and falling within income limits set by the program. U.S. citizens, permanent residents, and certain qualifying noncitizens may be eligible if other conditions are met.

Income Limits and Phase-Out Rules

The payment amount may be reduced as income rises. Phase-out thresholds differ depending on filing status, meaning single filers and married couples are evaluated using different income ranges. Those below the lower income limits are more likely to receive the full 725 amount, while higher earners may receive a reduced payment or none at all.

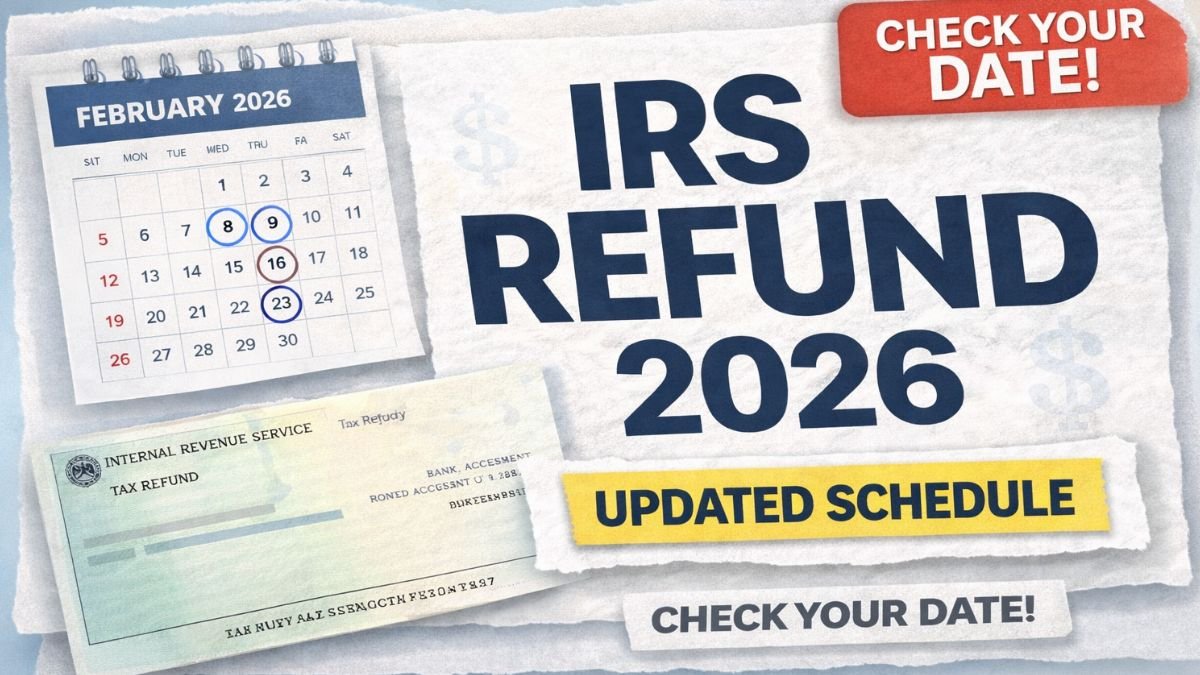

When and How Payments Are Sent

Payments are expected to be released in stages rather than all at once. Direct deposit is usually the first method used, followed by paper checks and prepaid debit cards. The IRS typically publishes updates and timing guidance on its official website, allowing recipients to estimate when their payment might arrive. Processing speed can vary depending on verification requirements and account accuracy.

Checking Your Payment Status

Recipients can track their payment using official online tools provided by the IRS. Some Social Security recipients may also see updates through accounts managed by the Social Security Administration. Keeping bank details and mailing addresses current helps prevent delays.

What to Do If Your Payment Is Missing

If a payment does not arrive as expected, the first step is to confirm eligibility and review payment status online. Many delays occur due to outdated bank information or address changes. In some cases, payments may be reissued after verification is completed.

Preparing for a Smooth Process

Filing required tax returns on time, maintaining accurate records, and monitoring official government announcements are the best ways to ensure timely delivery. Rely only on official sources and avoid third-party claims promising faster access to funds.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Eligibility criteria, payment timing, and program rules are subject to official government decisions and individual circumstances. Readers should verify details through authorized federal agency websites or consult qualified professionals before making financial decisions.