February 2026 is shaping up to be an important month for millions of Americans who depend on federal benefit payments. Social Security, SSDI, and a widely discussed $2,000 federal stimulus-style deposit are all expected to be processed during this period. For many households, these payments are essential for managing rent, groceries, medical costs, and other daily expenses. Understanding the expected timelines helps recipients plan their finances with more confidence and less uncertainty.

Social Security Payment Schedule for February 2026

Social Security benefits follow a structured monthly schedule managed by the Social Security Administration. Payments are usually deposited on the second, third, or fourth Wednesday of the month. The exact date depends on the beneficiary’s birth date. In February 2026, this standard schedule is expected to remain unchanged. Most recipients who use direct deposit will see their funds arrive on time, while those receiving paper checks may experience minor mailing delays.

SSDI Deposits and Timing

Social Security Disability Insurance payments are issued using the same schedule as regular Social Security benefits. This means SSDI recipients can expect their February 2026 payments to arrive based on their birth date as well. Direct deposit remains the fastest and most reliable option, reducing the risk of delays. Beneficiaries are encouraged to review their bank statements and official SSA communications to confirm the exact deposit date.

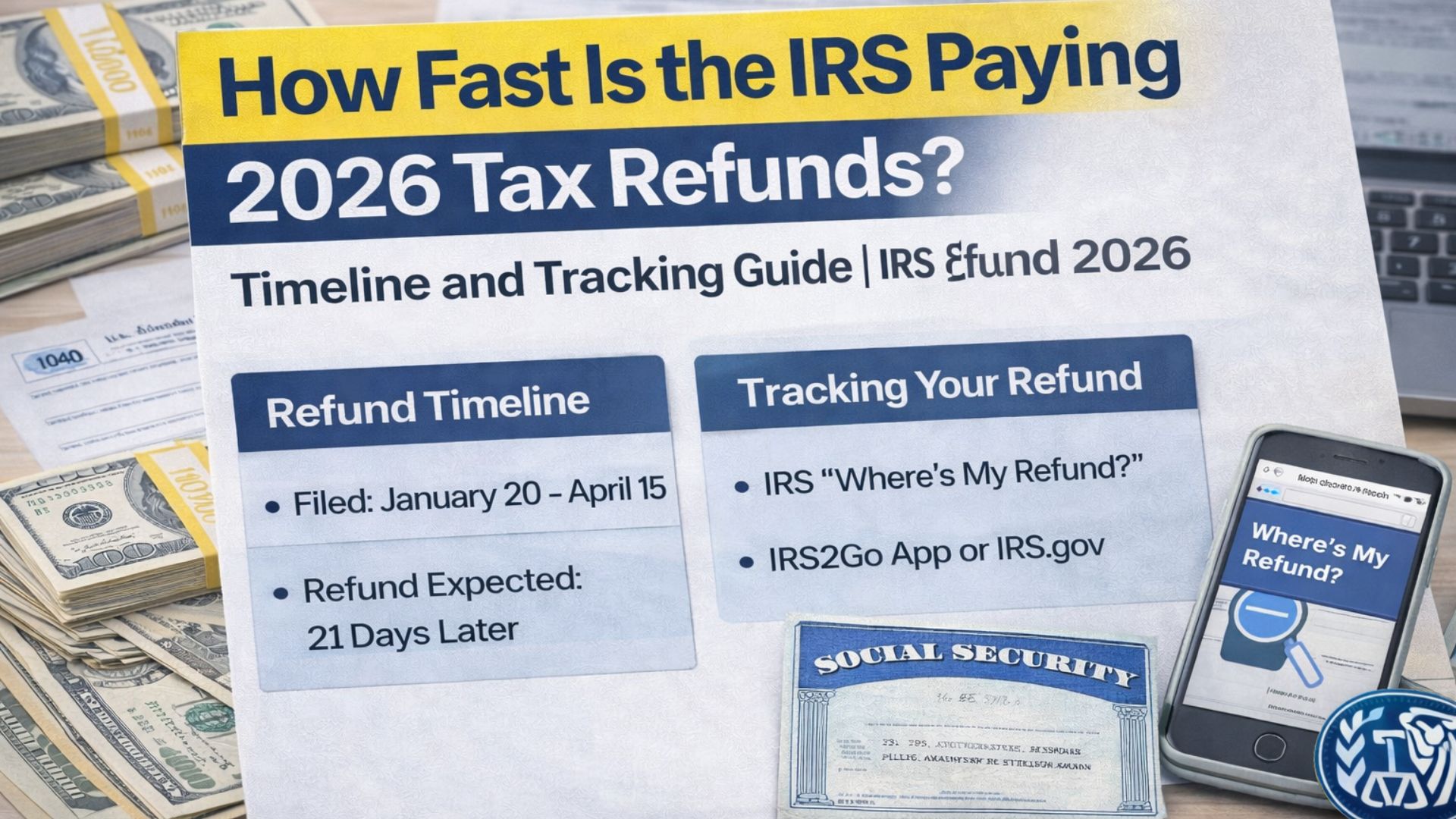

$2,000 Federal Stimulus-Style Deposit

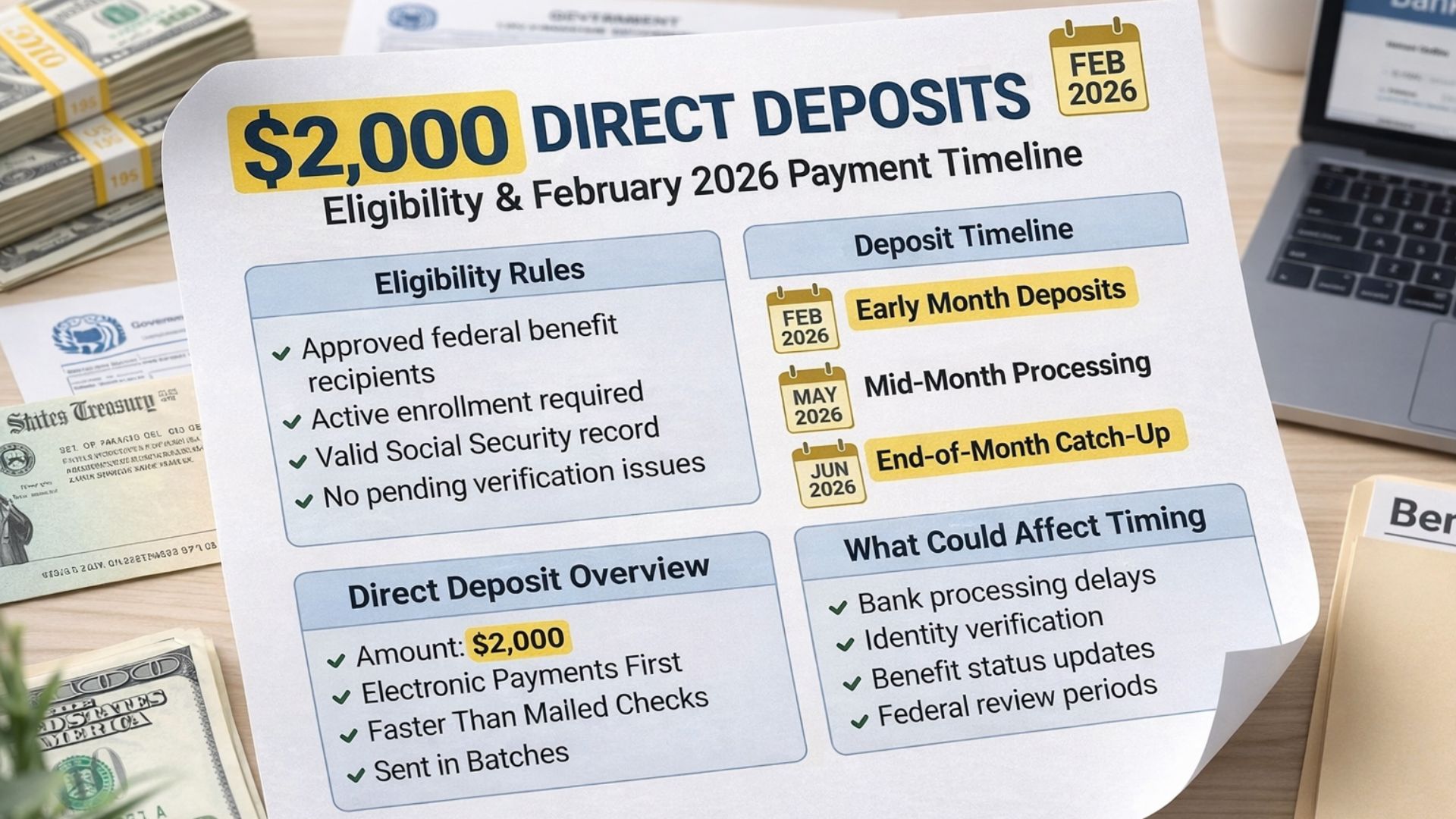

In addition to monthly benefits, eligible taxpayers may receive a $2,000 federal direct deposit in February 2026. This payment is processed by the Internal Revenue Service and is based on verified tax filings, income levels, and eligibility criteria. For most qualified individuals, the deposit will be sent automatically to the bank account already on file with the IRS. Those with outdated or incorrect information may face delays until records are updated.

Importance of Updated Banking Information

Keeping banking and personal details current with both the SSA and IRS is essential. Accurate information helps ensure payments are delivered without interruption. Official government portals allow recipients to check payment status and confirm that records are correct. Relying on verified sources also protects against misinformation and scams that often circulate during high-payment periods.

Planning Ahead for February Payments

With multiple federal deposits expected in February 2026, advance planning can make a meaningful difference. Knowing when funds are likely to arrive allows households to budget more effectively, cover essential bills, and reduce financial stress. Staying informed through official channels ensures smoother access to these important payments.

Disclaimer: This article is for informational purposes only. Payment amounts, eligibility requirements, and deposit schedules may change based on official announcements from the Social Security Administration, Internal Revenue Service, and the U.S. Treasury. Readers should consult official government sources for the most accurate and up-to-date information.